The UK market hit all-time highs again this week, which put me in my mind of this quote from Peter Lynch:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Stronger economic growth numbers have been bad for the bond market, but they have been good for the cheaper, unloved parts of the equity market. As I type, the UK All-Share market is almost 7% ahead of the US S&P 500 quarter to date (up 3% over here vs down -4% over there). And if there is one thing more unloved than the UK by global investors then it is surely Chinese equities. The China Hang Seng market is almost 12% ahead of the US for the quarter.

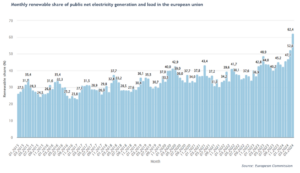

But I don’t want to jinx all this by writing too much about it. Instead, a couple of UK adjacent things that caught my eye this week. The first is the onward march of renewable energy. Ironically, it is right-leaning, fossil fuel rich Texas that is leading the way in the US. Texas is predicted to have over half its electricity come from carbon-free sources (solar, wind and nuclear) by 2025. This means it has almost caught up with the left-leaning, fossil fuel poor European Union, which for the first time in its history produced over half its electricity from renewables last month. The rapid growth of renewable energy (in which we are investors) feels like an under-reported story to me. I am happy to do my (very) little bit to correct that here.

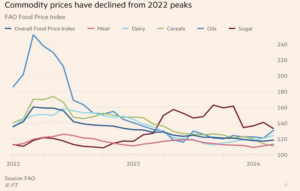

This should also help keep a lid on energy prices, and particularly oil which has been trading in a $70-$90 range so far this year. This is, of course, below the 2022 peaks and the same is true for food prices which continue to normalise, as the Financial Times showed a couple of weeks ago:

That said, oil is still up 10% for the year and copper is up 14%. This feels more of the good sort of inflation (responding to a stronger economy) than the bad sort (responding to a supply shock and/or a war). All this is helping the UK market which has an overweight allocation to energy and mining. The UK got to extremely, historically cheap levels in the second half of 2023. The problem with this is that current valuations tell you almost nothing about the next 12 month returns (the UK has looked “cheap” for the last 15 years during which it has chronically under-performed global equity indices).

Instead, it is fair to say that low valuations combined with an improving economy are proving to be good for cheaper markets such as the UK, Europe and China. In a world where bonds are struggling as promised interest cuts look less likely to arrive, these sorts of assets may well be a good hedge against any renewed bout of inflation.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.