This week I have some evidence that – in spite of what you may read in your normal daily newspaper – we do get some things right in the UK. But first some brief market commentary. Markets ended 2023 optimistically. They generally expected inflation to fall in 2024 but growth to remain strong. This really is as good a backdrop as an equity investor can have. So far this year, growth has indeed remained strong and this is true for the US, Europe and even China. But US inflation has started trending up again. This means this year’s promised 2024 US rate cuts might not appear at all. The Q1 equity rally has run out of steam so far in Q2.

We remain of the view that we are in a very different place to 2022. US inflation is not spiralling out of control but is probably in the 2.5%-3.0% range today. This is tolerable but not a level where the US Fed should be cutting rates. Also, this is really a US phenomenon so far. Inflation surprises have been more benign in Europe (see the chart below). Oil remains in its $70-$90 trading range. Europe is odds on to cut rates in June this year, and for the UK that date is August.

This means a more benign interest rate backdrop for the UK and Europe. The other tailwind these markets have is, of course, lower starting valuations. What you want to see is some takeover activity to help validate the idea that European equities really are good value. And this week we have finally seen some. A bidding war for Hipgnosis (music song rights) is a shot in the arm for the UK trust sector. And BHP’s bid for Anglo American is a similar boost for the FTSE 100. Short period I know, but the UK equity markets are the best global performers so far this quarter.

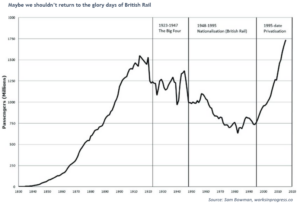

And in keeping with the idea it might not be as bad in the UK as our media would lead you to believe, the chart below caught my eye. It shows UK rail passenger numbers since 1830. It is striking to me that the two periods of strong growth (including today) came under private ownership. Anecdotally, foreign visitors I speak to are often pleasantly surprised by the UK rail system. It is certainly not perfect (nor is it cheap) but it is a lot better than it used to be. Privatisation, on this metric at least, looks to have worked.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.