Polarisation and Transparency: The 2022 ESG Wrap-up

The past year was a turbulent one for investors, especially for those of us focusing on ESG risks and themes.

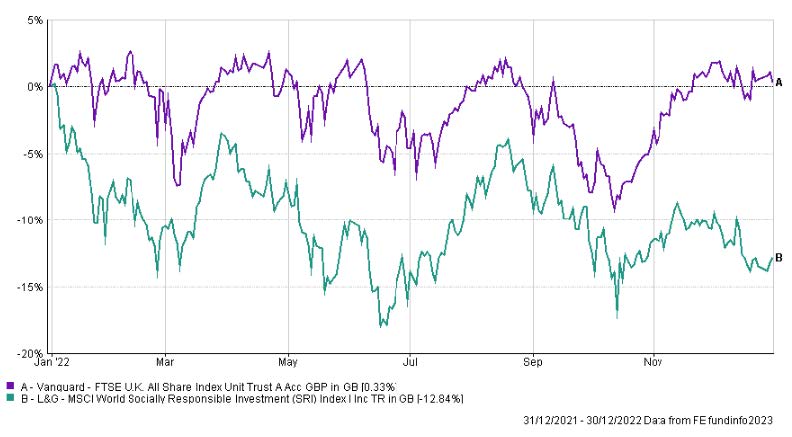

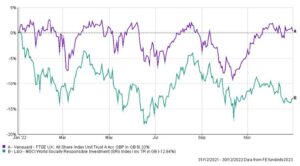

A change in global economic conditions and the subsequent high inflation initiated by the Russian invasion of Ukraine, prompted a sell-off in sectors with high ESG scores like technology and healthcare, while energy and commodities, which are notable exclusions, rallied. This can be seen in the graph below showing the energy and commodity heavy UK index against the All World ESG index.

Figure 1: UK Large Cap Equities vs ESG Global Equities performance in 2022

Safe and defensive assets such as green bonds also capitulated in 2022, in one of the worst bear markets the asset class had ever experienced, adding to the pain of multi-assets investors. Putting all this together we can make sense of ESG performance in 2022, which has been below what we hoped but in line with unconstrained investments.

2022 will be remembered as a year of controversy and polarisation, the rise of “anti-woke” movements and lobbying against sustainable themes, especially in the US, has threatened progress made by governments, NGOs and big institutional investors in ESG matters. Additionally, Florida pulled $2bn in assets from Blackrock Asset Management, to protest its support for sustainable investing, and Texas banned state contracts from going to financial institutions that “discriminate” against gun manufacturers and fossil fuel companies.

On the other hand, we witnessed important climate wins, with the election of Lula da Silva as the new president of Brazil, who has committed to protect the Amazon in a clear change of direction to his predecessor Jair Bolsonaro.

In the US, the approval of the Inflation Reduction Act, clears the way for hundreds of billions of spending on climate projects putting the US on a trajectory to significantly cut emissions by 20301.

While little progress was made by governments at COP27, supranational institutions and investors increased their ESG efforts throughout the year. The Norwegian sovereign fund committed to vote against companies lacking a net zero strategy and AXA reviewing their shareholders voting policy to promote diversity and representation on investee’s boards.

This dichotomy will likely persist over the coming years as ESG becomes more and more prominent in the policies of investors and governments alike. To some extent, resistance to change is key to every revolution, and although we expect a short-lived slowdown, we think it’s unlikely that this will translate into a major setback given the breadth and depth the trend has reached.

Transparency has been another key theme of the year, with initiatives coming from organizations but also from the public. Almost every developed market government has increased efforts to develop a consistent ESG nomenclature to facilitate investment flows, and an increasing number of websites are now disclosing information on climate and ethical conduct of business. Thanks to the effort of non-profit organisations, it is very easy to know where the most polluting companies operate, using satellite data and AI2 to track output, or even making sure businesses have actually cut ties with Russia following the invasion of Ukraine, courtesy of the Yale School of Management3.

In terms of the outlook for 2023, economists’ central case sees a slowdown in the pace of rate hikes from central banks, which could cause a mild reversion of what we have seen last year. If this happens we would expect stocks with longer duration such as utilities and technology benefitting from this trend, raising the expected return for sustainability-themed investments.

A decline in inflation in 2023 and a more resilient than expected global growth would also mean a rally in cyclicals such as semiconductors and industrials. As always, risks remain and, in this context, could materialise if energy continues to outperform as a sector, given the inevitable exclusion from sustainability-themed funds.

Tiziana Maida

Head of Research

1 The reduction is projected to be 40% by 2030 compared to 2005 levels

2 Available at www.climatetrace.org

3Available at https://som.yale.edu/story/2022/over-1000-companies-have-curtailed-operations-russia-some-remain