It’s a day with a Y in it so it’s probably time to write about interest rates and inflation again. Rather like the start of 2022, inflation has been surprising on the upside again this year in the UK and US and the expected 2024 interest rate cuts keep getting pushed further and further away. The first cut in the UK is now expected in August for the UK and September for the US (it used to be June for both). However, unlike 2022, equity markets remain up for the year and the 5 months from November 2023 to March 2024 was one of the strongest equity runs we have seen in recent history.

Part of the reason for this difference is that – from an equity market perspective at least – there is “good” inflation and “bad” inflation. Good inflation comes from the economy being strong with decent wage growth driving demand for the thing’s companies have to sell. Bad inflation is where there is a problem on the supply side which pushes up prices for certain products (often oil and commodities). More expensive commodities are like a tax rise everyone has to pay which leaves them with less money left over for their normal spending. This is often bad for equities. Putting it simply, 2024 looks more like “good” inflation driven by stronger growth whereas 2022 (with all its Covid related supply disruptions) had more of the “bad” inflation in it. Equity markets were hugely sensitive to inflation numbers in 2022, whereas for most of the last 12 months they have largely shrugged them off.

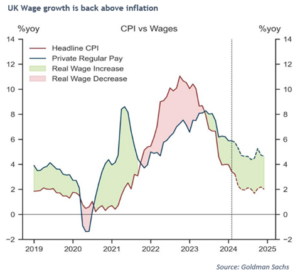

What could change this? Slowing growth would leave companies with less demand for their products but all the headaches higher inflation brings. We have, to be honest, been expecting a growth slowdown for the last 15 months and have been positioned accordingly for this risk. It may yet appear but the one thing I feel pretty good about is we are in better shape today than we were 18 months ago. Then, energy prices were rising as were taxes and the interest rate shock was just beginning. Today, energy prices are falling, some limited tax cuts are on their way and people have had 18 months to adjust to the new higher interest rate costs. One way to show this is to look at real wages (the wage you receive over and above inflation). This went positive (green in the chart below) in 2023 and is expected to stay there for the foreseeable future:

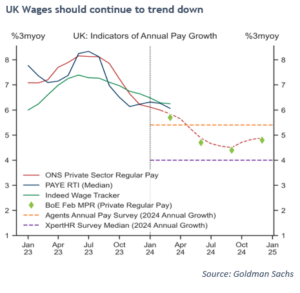

If the outlook for growth is better, could inflation accelerating again from here to cause a second shock? Here, again, I think there are reasons for optimism. Part of the recent pick up in inflation has been on the services side. Service inflation is linked to wages and forward looking survey data suggests they should continue to fall. The fact that unemployment has been rising in the last few months should also help keep the downward trend intact.

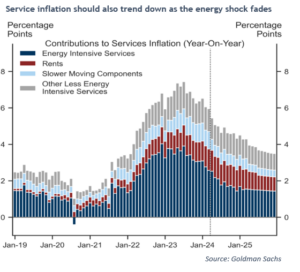

And finally, Goldman Sachs have done the work to break out the contributors to service sector inflation. A large part of it looks to be energy related. As the shock from the Ukraine war continues to fade so energy prices should continue to fall. This should also slowly help the services inflation picture.

I should add a personal mea culpa here. I was consistently too optimistic on the outlook for inflation in 2022 and was wrong. In 2023 I stuck to that view and (especially in the fourth quarter last year) finally had some joy. Here I am again saying inflation won’t re-accelerate in 2024. I may well be wrong. My only comfort is that I have been wrong so far in 2024 and our balanced portfolios (which all have an allocation to equities) are up for the year. Strong growth with “good” inflation is a problem for central banks but, so far, has not been a problem for my day job.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.