Summary

• Q4 finally saw some encouraging signs that inflation might have peaked in the US, the world’s largest equity and bond market. This eased pressure on central bankers to keep raising interest rates. Markets famously do not like uncertainty and it now looks like interest rates will peak at or slightly below 5% in the US and UK. Q4 saw a relief rally in equities and bonds.

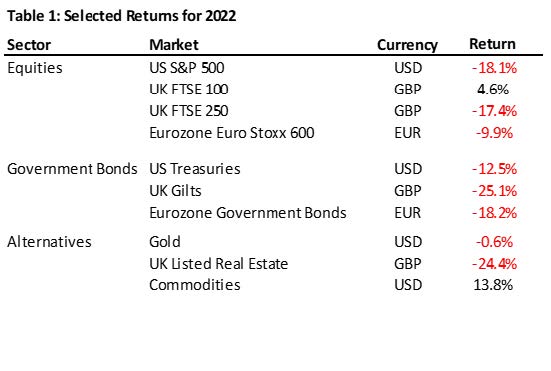

• The strongest performers for Q4 were those hardest hit in Q3. This included UK and European focussed equities, sterling and UK government bonds. UK assets in particular recovered some of their Q3 losses as the more aggressive parts of the Truss/Kwarteng mini-budget were rolled back. The FTSE 100 was the year’s best performing stock market mainly due to its large exposure to energy and mining companies.

• We had been waiting for this rally (and in truth we were too early for it in Q3). We added to fixed income early in September and October and our bond investments had a strong quarter.

• We also added healthcare equities across our portfolios. If a recession does come in 2023 then healthcare profits are less at risk than other sectors. This also enables us to keep some upside if – as is possible – the US avoids recession.

• Finally, as equity and bond markets became cheaper we have reduced our alternatives holdings. These remain an important part of our portfolios but we were overweight alternatives in part because of the very low yields available in fixed income when interest rates were anchored at zero. As rates have risen, our overweight to alternative investments has reduced.

Q4 Overview

We try, as much as we can, to focus on investments from the bottom up. This means concentrating our attention on assets that are priced to generate attractive long term returns and then making sure we can ride out the inevitable ups and downs along the way. Every few years, however, it is only the top down macro environment that really matters. 2022 was one of those years. After lying dormant for 20 years, inflation finally broke out again. Shutting down factories but paying people anyway

in 2020 and 2021 meant the same amount of money ended up chasing fewer goods in 2022. The energy price shock caused by Russia’s invasion of Ukraine threw fuel onto the inflationary bonfire. Interest rates started rising faster and further than they had since the 70s. As interest rates rose so asset values fell.

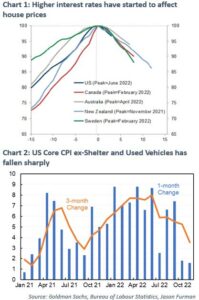

There were signs in Q4 that this part of the cycle might be nearing its end. Inflation – and especially inflation linked to pandemic disruptions – looks like it might have peaked. One way to illustrate this is to look at US Core CPI and then take out Used Vehicles (volatile and falling fast) and Shelter (the US measure of rent and house price inflation). Shelter is an important and large part of CPI but, unfortunately, because of the way it is calculated it lags current price movements by around 12 months. Now, it is very fair to say that 18 months ago inflation was actually understated because this Shelter measure was not picking up sharp increases in rent and house prices. But today the opposite is true: rents and house prices have peaked (see Chart 1). New home sales in the US are now down -40% year on year. As Chart 2 shows, monthly inflation on this measure has been below the Fed’s 2% target for the last 2 months. Oil is down over 20% from its peak in the summer. Inflation goods (physical things) is turning negative for many assets.

The other dominant theme in 2022 was the collapse of many of the speculative bubbles that grew up in the last few years. One example would be technology names like Peloton and Zoom that have struggled to show any growth now that life has, more or less, returned to normality. We also wrote in previous Overviews about the insanity that was the Tesla stock market valuation. This is now down over 70% from its peak and trading at 22 times next year’s forecast earnings. You might still think this is expensive but for the technological leader in a new and growing market it is not crazy.

Where the major asset classes stand today

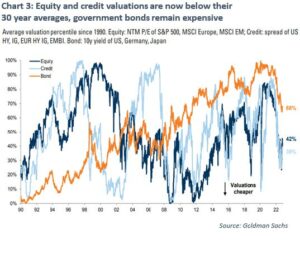

If the peak is in (or close to being in) for inflation and the all-things technology bubble has burst where does that leave us? The first point to make is that, after the falls seen in the first 9 months of the year, valuations are not expensive any more relative to recent history at least. Chart 3 shows valuations today for equities, government bonds and corporate credit compared to their 30-year averages. Government bond yields are still expensive on this measure but equity valuations look attractive as do the returns from corporate credit.

Equities

The most important risk market for most of our portfolios is, of course, equities. Although valuations matter a lot for longer term returns, they don’t help much in the short term. Instead, we think one of these three scenarios will drive markets in 2023:

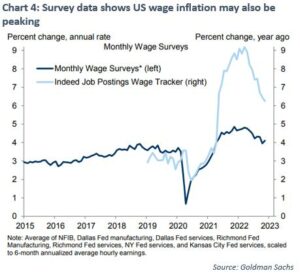

1. Inflation: What looks like a peak in inflation is really a pause and inflation remains stubbornly high. The most likely reason for this is continuing strength in the US labour market and wage inflation. There are also some encouraging signs here (e.g. see Chart 4 on wage survey data) but wage inflation will need to fall from current levels to be consistent with a 2% inflation target. This will keep the pressure on central banks to keep raising rates and the cycle we saw in the first 9 months of the year (higher rates pushing asset values down) will continue into 2023. UK wage inflation is also uncomfortably high today (running at over 6% p.a.). The Bank of England will need to see this moderate and start to fall before it can say the inflation crisis is over.

2. Recession: Interest rate rises only hit the economy with a lag of around 6 to 18 months. This means recent rate rises have yet to filter through to the rest of the economy. Examples would be mortgage borrowers slowly rolling off fixed rate deals onto floating ones or businesses refinancing their debt. The risk is that these rises, plus the impact of higher energy costs, cause consumer spending to fall fast in Q1 and trigger a recession. This is a very real risk. It looks much more likely in the UK given the higher exposure to short term fixed and floating rate mortgage debt and the larger energy price shock but it is also present in the US.

3. Soft Landing: The US avoids a recession in 2023. This is not our base case but the average of professional forecasters puts the chance of a US recession at around 65%. This still leaves around a 1 third chance that the worst does not happen and, as we discuss above, the US economy is currently in a good place. This is not a scenario we can ignore.

We have used the Goldilocks analogy before, but one way to think about this is that the US economy can run too hot, too cold or just right. Today we think too cold or just right are more likely than too hot. This is the reason we increased our bond holdings in Q4 and also the reason we added healthcare (a sector whose earnings should be less exposed to the US). We are, however, very aware that inflation consistently surprised on the upside in 2022. We are a little underweight equity overall and are reluctant to increase our exposure as long as inflation risks remain.

We have talked about the US above because it is the world’s largest equity market and where it leads other markets often follow. The UK and Europe also, of course, have to deal with the brunt of the energy price shock coming from the Russia and Ukraine war. Equity prices look very attractive on many measures in the UK and Europe, in part because the short-term headwinds look so strong. We do not want to be overweight these markets going into a recession (as looks much more likely for them) but we are ready to add when the impact of the energy and interest rate rises become clearer. At today’s prices, they look like a very attractive longer-term opportunity.

Finally, a word on China. China is at last ending its zero-covid policy and its economy may well have an exit boom of its own. This cuts both ways. One reason energy and commodity price inflation has been easing has been weaker demand from China. This should reverse into 2023. That said, a burst in China growth should be good for Asia and for global growth. This is another reason not to be too bearish overall today and we are maintaining our Asian equity exposure. As with the UK and Europe, today’s valuations are attractive.

Fixed Income

We also wrote last quarter about the opportunities we were seeing in fixed income. These were particularly striking for our UK and sterling-based clients due to the disruptions caused by the Truss/Kwasi Kwarteng failed mini-budget. We added to our fixed income in September and October 2022 to be, for the first time in a long time, overweight this asset class. Our fixed income exposures delivered solid returns in Q4.

That said, inflation risks remain. We therefore mainly invested in shorter maturity, lower risk corporate bonds which are less exposed if interest rates rise. Even after the Q4 rally we can still earn over 5% returns in sterling and US dollars with average maturities of less than 3 years. We are essentially being paid a respectable return to wait while the economic picture unfolds. We continue to like this opportunity.

Alternatives

After struggling in Q3, our alternatives stabilised in Q4. Our alternative assets are the epitome of a bottom up approach to investing. They are designed to provide sources of income and return that are different from – and independent of – the broader business cycle. They are focussed on renewable energy, specialist property and general infrastructure (including roads, schools and hospitals). They are continuing to deliver the cashflows we were expecting and are positioning today to generate 5% to 7% net returns with some inflation protection.

That said, as we mention above, the returns from low risk fixed income investments are now at the bottom end of the returns we expect to get from alternatives. We therefore cut our alternatives overweight in Q4. Our alternative investments will continue to be an important part of investment portfolios and approach but, today, there are good opportunities in traditional equity and bond markets.

Property

Finally, a word on physical property. We do not own physical property directly (though we do have small indirect exposure via listed real estate investment trusts). We have estimated internally that the impact of interest rates rising from 1.5% area in the UK to around 5%-6% would be up to a 30% fall in residential property values if mortgage repayment amounts are held constant. Listed commercial property trusts have been trading at similar discounts to their net asset values. We would be surprised if we actually see falls this large. As the economy slows property prices should cool off but interest rates should also start to fall again to help cushion the blow. That said, physical property values adjust slowly to reality.

The zero-interest rate world is over. Public markets now reflect this and we continue to think there are better opportunities in public markets than private ones.

Finally, as another year comes to end, can I take this opportunity to wish all of our clients a happy and prosperous New Year. As ever, if you would like more information on our positioning and portfolios, please do get in touch.

Chris Brown

Chief Investment Officer

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.