The role of improvers for Climate Transition

One of the crucial takeaways from COP27– the annual climate summit held last November in Sharm El Sheikh – was the realisation that we are still on track for a world where temperatures are 2.4-2.9°C higher than pre-industrial levels. The world compatible with this level of increase is one where climate disasters are the norm and where heat-related deaths in critical areas such as North Africa and the Middle East are expected to increase 60 times compared to today’s (1).

Government action towards the development of a climate mitigation and adaptation strategy must be supported by private capital. COP27’s attendance by institutional investors was at a record high which gives me comfort that momentum around climate solutions is accelerating. At the same time, investors have to strive to improve and continuously challenge the impact their ESG policies and investment decisions have in the world.

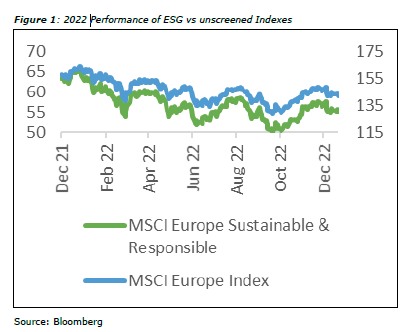

When it comes to ESG investing, negative screening has generally dominated financial product evolution for the past ten years until 2022 prompted a shift in the narrative.

Exclusionary mandates have been popular for a reason: they are relatively easy to implement, they resonate with people wanting to make a positive change, and they’ve historically been supported by good investment performance.

Regulation also plays a part. For instance, the EU Sustainable Finance Disclosure Regulation (SFDR) classifies funds under three labels: article 6, article 8 and article 9, where the last two promote environmental and/or social characteristics and have a sustainable objective respectively while article 6 refers to funds claiming no ESG attributes.

This characterisation may seem flawed to some, because it contains an implicit ranking, but investing in sustainable leaders might not necessarily be the most impactful and effective way to contribute to the climate transition. First, because decarbonising your portfolio does not decarbonise the real world and second, divesting en masse from ESG laggards does not necessarily punish management as long as there are investors out there who are willing to buy.

Put simply, transferring high-emitters from one portfolio to another is hardly a structural solution(2).

We are witnessing a shift in mentality among fund managers with an increasing focus on companies which are far from being ESG leaders today but express a credible willingness and commitment to achieve net zero in the near decades. If they have a sound plan in place and make decisions consistently with that plan, the investments can prove to have more additionality when it comes to measuring climate transition contributions.

At IPS Capital, we are always on the lookout for credible strategies with a repeatable investment process and consistent performance. Best-in-class strategies will always be at the core of what we want to offer investors, but we are becoming increasingly inclined to add to transition stories where management is reliable, especially if these represent underappreciated opportunities – not only to benefit the planet – but also to improve portfolio diversification and capture alpha as these investments build ESG momentum.

Tiziana Maida

Head of Research

_____________________

(1) Lin Noueihed, Global Warming Threatens Soaring Death Toll in Middle East, Bloomberg, April 2023

(2) Bril, Herman, et al, Sustainable Investing 24 Sept 2020

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.