Summary

The biggest concern in 2022 was that inflation – and the interest rate rises needed to tame it – would keep spiralling out of control. The good news so far this year is inflation is starting to fall. This means interest rates look to be nearing their peak (if they are not there already).

- Some stabilisation in inflation and interest rate risks helped provide a platform for equites and bonds to rise for the quarter.

That said, last year’s sharp rise in rates has certainly caused some casualties. Four banks (including Credit Suisse) failed in March. This raises the risk of a 2008 style credit crunch as banks cut lending and look to strengthen their balance sheets.

That said, last year’s sharp rise in rates has certainly caused some casualties. Four banks (including Credit Suisse) failed in March. This raises the risk of a 2008 style credit crunch as banks cut lending and look to strengthen their balance sheets.- In spite of all that has been thrown at it (rising rates, rising energy costs and now failing banks) the global economy remains remarkably resilient. The post-Covid cycle is fundamentally unlike any that has gone before. Our decision not to get too defensive at the end of 2022 has worked so far in 2023 (see Table 1).

- That said, recession risks are rising. During the quarter we added to more defensive bonds. After 2022 these carry attractive yields and look well placed to weather out a recession if and when it arrives.

- We also cut our exposure to riskier bonds (specifically US high yield corporate credit) as this looks to be most exposed to any further problems in the banking sector.

Q1 Overview

My job here is to write an easily understandable account of what happened over the last 3 months. This quarter the job is not that easy. The year began with investors convinced inflation had peaked and a recession was around the corner. Equities proceeded to rise. Strong data in February meant that recession fears were replaced by worries that the economy was running too hot and interest rates might have to keep rising further. Even though a strong economy is good for corporate profits, equities fell. In March we had four bank failures (Silicon Valley Bank and Credit Suisse being the largest). Credit lending standards had already been tightening before these failures and the fear remains that banks will tighten lending criteria further to protect their solvency and capital. This will have predictable knock on effects to many parts of the economy including, most obviously commercial real estate. In response to all this, equity markets … went up!

What can we make of all this? One obvious point is to remember to stay humble. Whatever your view of what should happen, other things can and will happen. This is one reason we always try and keep a diversified mix of investments in our client portfolios and not get too bearish (or bullish) no matter how good (or bad) the outlook appears to be.

That said you can, I think, see that equity markets still fear inflation (and runaway interest rates) more than anything else today.

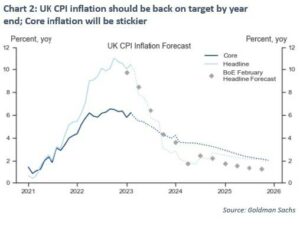

The last 6 months have seen inflationary tail risks recede and this has been the main driver of the rally we have seen from 2022’s lows. Chart 2 shows the latest Goldman Sachs and Bank of England inflation forecasts for UK inflation for example with headline CPI forecast to (almost) hit around 2% by the end of the year. The precise data points of these projections will no doubt be wrong but the overall direction is clear. Inflation is falling back to close to central bank targets.

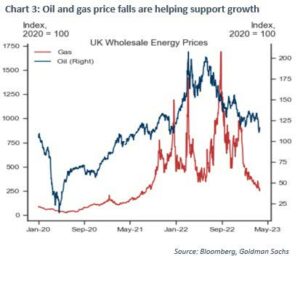

The other piece of good news for the quarter is that we just don’t see much of a slowdown yet in the real economy. Unemployment (still below 4% in the UK and US) is close to its all-time lows. Consumer spending is solid, helped in part by energy prices which have fallen from their highs 6 months ago (see Chart 3).

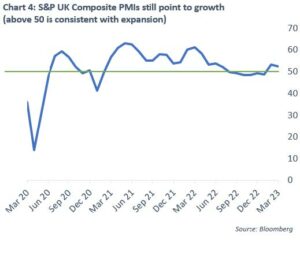

The resilience of the UK consumer to first Covid, then war in Ukraine and finally the Truss/Kwarteng budget and interest rate shock is just remarkable. It is quite possible consumers will wake up to realise – like many a 1950s cartoon character – that they are in fact over the edge of the cliff, look down and their spending will suddenly plunge. But we are not there yet and, if anything, there are signs that activity is picking up once again with forward looking survey data still pointing to expansion in the US, Europe and the UK (see Chart 4).

Outlook for the rest of 2023

At a high level, we remain a little underweight equities, overweight bonds and neutral alternatives. It is always tempting, of course, to go on the defensive in case a recession comes along. But economists and forecasters are famous for being able to predict 5 out of the last 2 recessions. A year ago, there was supposed to be a big recession right about now for example. The other thing that gives us pause for thought is, as was the theme in Q1, there is plenty of good news out there to balance out the bad.

To illustrate this here are three causes for optimism that can be switched to potential bad news without much effort. First, the good news:

Banks: So far, the policy response looks to have been pretty effective with policy makers having learnt from the 2008 financial crisis. The weak have been pushed into the arms of the strong. Depositors have been protected. In Europe at least, higher capital ratios and tougher regulation mean that the sorts of dominoes you might expect to see fall next (like Deutsche Bank for example) will prove tougher nuts to crack. Indeed, bank share prices are starting to recover after the initial Silicon Valley Bank and Credit Suisse shocks.

Interest rates and inflation: As I wrote above, inflation looks to be heading in the right direction (though arguably not falling fast enough). Historically, federal reserve pauses (and particularly peaks in 2-year interest rates) have been very favourable for equity markets. We saw some evidence for that this quarter.

Valuations: Especially after last year’s falls, valuations in many markets are just not that challenging. The FTSE 100 trades at around 10x earnings. For those that worry about

a reacceleration in inflation the US energy sector now trades at just 9x 2023 expected earnings.

Unfortunately, it doesn’t take too much effort to turn this positive narrative around:

Banks: The impact of the recent failures will surely be for banks to rein back their lending. This combined with the recent sharp rises in interest rates will only make life harder for businesses and borrowers. I don’t think the credit crunch will be anything like the one we experienced in 2008, but a credit squeeze is surely on the way.

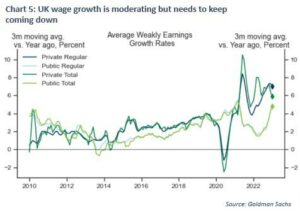

Interest rates and inflation: Although there is plenty of good news on inflation, wages are still running too high (see Chart 5). Can wages fall without the pressure of rising unemployment? History would say this is very unlikely. Central banks certainly think a mild recession is the only way to finish the job of bringing inflation back in line.

Valuations: Though certain sectors and regions are trading cheaply, the most important market of them all, the US, is not. An earnings multiple of 18.4x for the S&P is equivalent to an earnings yield (i.e. the corporate profits you get divided by the price you pay) of 5.4%. Why take all the risk and drama of equities for a yield that is barely above cash deposits?

Putting this together we still lean a little cautiously in our portfolios, but we have enough market exposure to capture enough of the upside if (as we have seen this quarter) economic growth holds steady.

As always, if you want to discuss your portfolio, positioning or anything else please do get in touch.

Chris Brown

Chief Investment Officer

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.