Summary

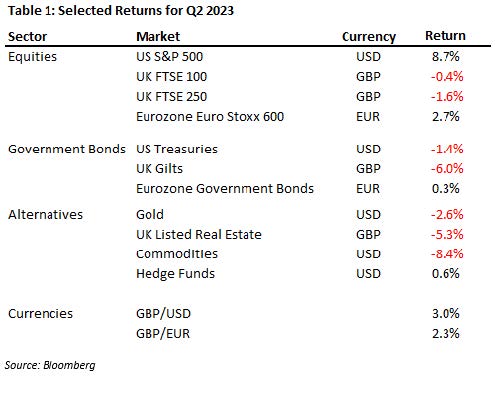

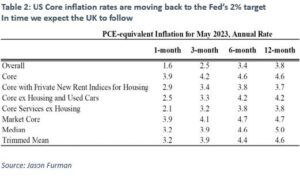

- 2023 has continued to surprise forecasters. Equities rose inQ2 as the much-anticipated slowdown has yet to materialise. The global economy has been remarkably resilient (so far)to rising interest rates.

- That said, equity gains were concentrated in a very narrow list of familiar US technology giants including Amazon, Apple, Microsoft, Google and Nvidia. Outside of these names US markets were broadly flat. Apple by itself now has a larger market capitalisation than the entire UK FTSE 100 Index.

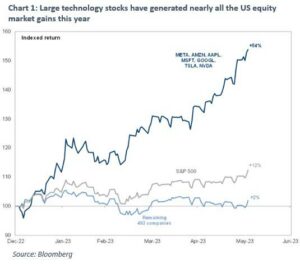

- Inflation pressures continue to be stronger in the UK than in other major economies. UK interest rates are now expected to rise above 6% by the end of the year compared to an expected peak of below 4% for the Eurozone and 5.25% in the US.

- This pushed UK bond yields up and prices down. High quality bonds yielding above 6% are an attractive opportunity today with the potential for some capital gains if and when the slowdown comes.

- Rising interest rates have also pushed down prices for our investment trust assets including renewable energy,

specialist property and infrastructure. These now generally trade at a discount to their net asset values. The earnings potential of the underlying investments is unchanged however. These look to be well placed to meet their return targets over the next few years.

2023 First Half Overview

Here are a few of the things investors expected at the end of 2022. Higher mortgage rates and energy prices would hit consumer spending and trigger an economic slowdown. China would have a boom after it finally ended its Covid restriction. Energy prices would stay high as the effect of Russia’s war lingered on. The bursting of the technology bubble would mean new sectors (energy and commodities perhaps?) would offer the best returns for investors.

Well, so far, none of this has come to pass. The economy has remained remarkably resilient even with interest rates at 5% (and rising) in the UK. Given the doom and gloom amongst many investors at the start of the year, this has been enough to see equities have a strong first half of the year. The expected recession just did not arrive. The second surprise has been what has been behind this rally. Rather than coming from a Chinese rebound or oil and commodity producers, US technology giants have once again been leading the way. As I write, Google is up +35% for the year, Amazon is +52%, Meta (the old Facebook) is +134% and Nvidia is up +179%. This means the equity gains we have seen have been very narrow and concentrated in the US. Even within the US the market is broadly flat outside a number of familiar technology names (see Chart 1).

This sudden re-ignition of interest in technology investment has been driven by the recent advances in Artificial Intelligence (AI) and the changes this will bring to many businesses. AI is very computationally intense and so the chip-makers (of which the best is Nvidia) look to be certain winners. There is also a view that the large technology incumbents (like Google and Facebook) will be on the right side of this revolution. We shall see. I am pretty sceptical of the ability of investors to predict the long run impact (good and bad) of new technologies and we are still in the early days of AI. The one lesson we do take here is the importance of a diversified equity book. In 2022, the UK’s FTSE 100 was the best performing major market. In Q1 2023 that honour came to European equities. Last quarter the US market once again took the lead. We have had investments in all three markets and will keep our diversified approach into the second half of the year.

The other surprise has been that the economy that should in theory be the most sensitive to rising interest rates has been the one with the most resilient inflation problem. The UK has more mortgage debt than Europe and it is generally floating rate or fixed for short periods. This contrasts to the US with its 30-year fixed rate mortgage market. Yet the UK economy has remained strong and this has led to wage growth that is faster than other developed markets and a more stubborn inflation problem (Chart 2). This has forced the Bank of England to raise interest rates faster in the UK than elsewhere. The UK government bond market fell -6% in price terms in the quarter and interest rates are now expected to peak at over 6% by the end of the year. This contrasts to a peak of under 4% (and much calmer bond markets in general) for the Eurozone.

Equities have risen this year as the economy has been stronger than many expected. Bonds have fallen for a similar reason (a stronger economy ultimately means higher rates for longer). What of our alternative investments? We deliberately invest in a diverse range of alternatives. We do, however, have a concentration in investment trusts focussed on real assets such as renewable energy, specialist property and infrastructure. We invest in these because we believe the underlying asset (such as a wind farm for example) can deliver steady, inflation protected cashflows for our clients. This has indeed been the case.

However, the rapid rise in interest rates has lowered the equity prices these assets trade at. After trading fairly close to their net asset value for over 5 years, our trusts now trade at, on average, a sizable discount. Simply put, this means it is cheaper to buy a wind farm, say, by buying equity in an investment trust that owns one than it is to buy one outright. To illustrate this, Chart 3 shows valuations for a representative portfolio of investment trust assets owned in our portfolios. The blue shaded area shows a steadily growing net asset value (which are the assets you ultimately own). The orange line shows the share price of these investments. These tracked the net asset value up fairly closely until the middle of 2022, from there on in it has diverged pretty sharply (initially triggered by the Truss/Kwarteng mini-budget shock). This divergence has not helped our year-to-date returns of course. But owning attractive assets at a discount (as we do today) should mean we are well placed to earn the returns we expect from them over the next few years.

Second Half Outlook

Let me issue my two usual caveats here: (i) making predictions is hard (and this year is a great example) and (ii) it is often the surprises that matter more for markets in the shorter term. Surprises, are, by definition, hard to predict. That said, we remain positioned for interest rates globally being at or near their peak levels. This should mean our fixed interest investments (many of which are back to yielding 6% or more)

should deliver their yield and maybe turn some of last year’s capital losses into capital gains, if and when the economy does start to slow. As we discuss above, this should also provide a platform for our investment trust assets to recover close to fair value. So, in short, we think the laggards of the first half of the year might turn into the winners of the second half.

Why is this? Firstly, we remain stubbornly optimistic the inflation picture will keep improving, even in the UK. US inflation looks to be on track (see Table 2) and we think, eventually, the UK will follow. Stronger sterling and cheaper oil and energy should eventually feed through into the economy. The weakness we are seeing in the manufacturing and construction parts of the economy should eventually feed through into services and put a cap on wage increases. Global equity markets have already been trading as if inflation is last year’s problem. The UK inflation problem has been different (and worse) but ultimately, we don’t think the UK will be that different.

We are therefore optimistic for the outlook for the more defensive investments we have on. What does this mean for our equity investments which typically prefer stronger economies over weaker ones? Well, we are back to a world where the US looks expensive and rest of the world is cheap (see Chart 4). But, of course, software and technology are transforming the business world and it is the US technology sector that is dominating this revolution. You are effectively paying up for the better growth prospects US companies have to offer (and have delivered over the last decade).

For the last 10 years (and the last 6 months) this has been the right choice to make. Still, you can see from the chart that UK equities are back to having a price/earnings ratio of below 10 times which, historically has been a buying opportunity. One way to think of this is that you are making north of 10% earnings yield on your UK investments. Over time, this should also, of course, have some growth and inflation protection. A 10% earnings yield today should mean that hitting longer term equity returns of around 8% per annum is very achievable from here.

For the last 10 years (and the last 6 months) this has been the right choice to make. Still, you can see from the chart that UK equities are back to having a price/earnings ratio of below 10 times which, historically has been a buying opportunity. One way to think of this is that you are making north of 10% earnings yield on your UK investments. Over time, this should also, of course, have some growth and inflation protection. A 10% earnings yield today should mean that hitting longer term equity returns of around 8% per annum is very achievable from here.

We therefore continue to favour a barbell approach of a material allocation to the US market combined with cheaper opportunities (like UK equities) available elsewhere. After the surprises we have seen this year, I wouldn’t want to predict which of these approaches will do better, but I am glad to have them both in our portfolios. From today’s starting valuations, there is no reason to think this approach won’t deliver the sort of equity like returns longer term investors have seen and expect.

Chris Brown

Chief Investment Officer

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.