Why I want to own ESG in a recession

The probability of a recession in 2024 according to Bloomberg consensus is 55 percent. This is far from the 70 percent predicted for this year in Q1 – which luckily failed to materialise – but it is still quite high. Put in other words, investors believe that next year a recession is more probable than not.

Why is this? Global profits have been falling consistently through the year despite the increase in stock prices, while aggregate spending is slowing after a strong summer of Barbie, Oppenheimer and Taylor Swift concerts. Tightening financial conditions due to higher interest rates and increasing oil prices put the consumer in a difficult spot, especially with the end of the US student loan moratorium from Covid approaching.

Should ESG investors be worried more, as much or less than conventional investors in a recession? The former is the right answer in my opinion and I’ll try to elaborate why.

The link between a company’s financial stability and its dedication to ESG principles is intuitive.

Companies with a robust governance profile, which have invested substantially in strengthening their financials, are more likely to safeguard them and assess the potential impact of ESG factors on their long-term profitability and stability.

They are also more inclined to implement suitable measures to address any risks that may materialise.

Furthermore, from our perspective, approaching ESG investing with a multi-asset mindset broadens the opportunity set and allows complementary sustainable and responsible investments in equity markets with a variety of diversifying asset classes such as fixed income and investment trusts, which provide support to performance. Last year was a good example of this.

Despite being a precarious year for ESG equities given the broad market sell-off and the structural lack of commodities and energy stocks, having exposure to diversifying assets was accretive to overall portfolio performance, thanks to the high quality and uncorrelated nature of the underlying cash flows.

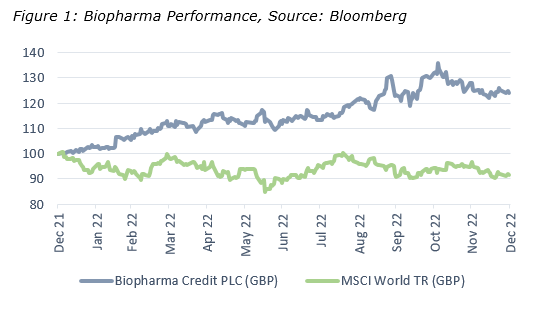

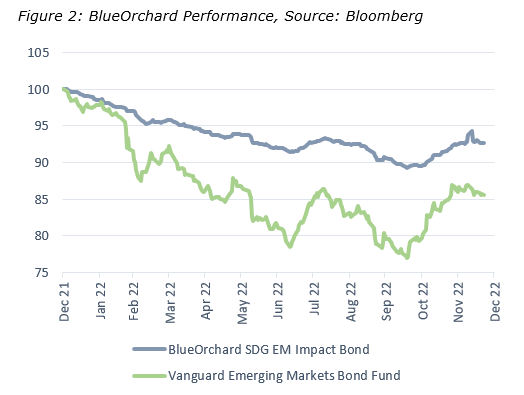

Biopharma Credit LLP and BlueOrchard SDG EM Impact Bond Fund are both great examples of this effect.

Biopharma is an LSE listed investment trust which acts as a lender to biotech companies domiciled in the US and the UK, providing loans backed by patented drugs which have already reached a commercial stage and thus have a sales track record. Since the life science market is less sensitive to the business cycle, Biopharma has been able to achieve its targeted return of 8% per annum – without suffering the volatility associated with pharmaceutical equities.

In 2022 Biopharma returned 23.8%, including a special dividend, while global equities were down 8.42%

Another portfolio asset, the Blue Orchard SDG EM Impact Bond Fund invests in debt securities issued by emerging market financial institutions with a proven track-record in serving small and medium enterprises and supporting underprivileged communities in developing markets. The main geographies the fund focuses on are Latin America, South East Asia and Africa. Typical examples of borrowers include: supranational organisations such as the African Development Bank, which mobilises resources for infrastructure investments in member countries; Credito Real Mexico, a financial institution that assists low and middle-income borrows; and Bank Rakyat Indonesia, which provides support to Micro, Small and Medium Enterprises.

The high-quality profile of the issuers as well as the exclusion of problematic regions such as China, Qatar etc. was the main driver behind the risk-adjusted overperformance compared to a broad emerging market debt index without ESG overlays.

In 2022 BlueOrchard was not completely immune to the fixed income sell off and rising rates but it managed to deliver a total return of -7.4% which compares favourably to the -14.5% posted by Vanguard emerging market Bond which is an unconstrained emerging market bond fund.

Obviously past performance is not necessarily a good indicator of future returns and every recession has its own idiosyncrasies. The timing and magnitude of a downturn is really outside of our control so what we prefer to focus on is picking funds which display resilient characteristics through investing in quality assets.

Tiziana Maida

Head of Research

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.