Impact and Returns: the case for Emerging Market Debt

While many of our readers might be used to hearing concerning news when it comes to climate, today I wanted to highlight a couple of positive statistics that came across my desk in Q1.

First, $1.3 trillion was invested in climate finance globally over the course of 2023. This represents a new all-time record.

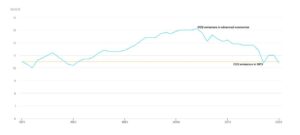

Second, there’s a clear positive trend in emission reductions. Net greenhouse gases produced by developed markets have decreased by 4.5% in 2023, representing the largest percentage drop in advanced economies outside of a recessionary period since 1973.

Before we become too optimistic, I must disclose that despite this positive figure, global emissions still ended the year higher by 1%. Emerging markets are the main culprit, offsetting the developed markets decline.

Figure 1: CO2 emissions from combustion in advanced economies, 1973-2023

Source: IEA

Source: IEA

It is therefore evident that more efforts are needed to support developing economies’ transition to the green economy, especially because these regions are the most exposed to the devastating effects of climate change.

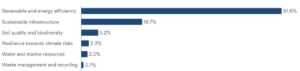

It is also interesting to note the contribution that private capital could make and how still underappreciated this is. Of the total green investments made in the region, 75% is allocated to public infrastructure and climate change mitigation. Large infrastructure projects backed by governments are essential, but we would argue so is adaptation, i.e. strategies that help societies adapt to the effects of climate change that are already with us.

Private capital could address these, pursuing profitable outcomes while addressing a redesign and improvement of food systems, urban infrastructure and climate insurance to name a few.

In addition to the impact considerations, there are other macroeconomic factors and secular trends that make investing in emerging market debt appealing today. These regions are experiencing positive tailwinds, as central banks implement rate cuts following deflationary pressures and regions like Latin America and India emerge as buffers countries and preferred investment partners amid tensions between China and the US.

Here at IPS Capital, we recognise the opportunity of investing in this space. Our preferred manager of choice is BlueOrchard, an impact investment manager that specialises in microfinance, green and impact bonds aimed at addressing global social and environmental challenges.

Thanks to the multi-decade experience, the consistent track record, localised knowledge and an international on-site presence in emerging markets, we believe they are well positioned to achieve the dual objective of diversifying the portfolio from a geographic, thematic and asset class perspective while continuing to strengthen long-term business resilience and achieve global climate goals.

Their proprietary B. ImpactTM framework is considered best-in-class in the industry and analyses each issuer across the dimensions of ESG risks, Impact intent and SDG mapping, where a material assessment is carried out to align proceeds with impact key performance indicators.

Figure 2: Top Impact themes addressed by the fund (as % of total amount invested)

Source: BlueOrchard IM

Potential investments go through a rigorous vetting process, with over 1200 rejected for not meeting the requirements since inception. An example of this is a utility company based in Mexico where the potential impact of the bond’s proceeds clashed against the significant harm imposed on the environment by the company’s operations, improper disposal of electric waste and the lack of engagement with indigenous population when planning new projects.

One example of the creditors that made it into the fund instead would be ReNew Power. This is one of the largest renewable energy independent power producers in India with a total of 7570 MW of installed capacity.

The company generates 1648 GWh of renewable energy, equivalent to the average yearly use of 2 million Indians, and also offers programs related to energy access in rural schools. Due to the attractiveness of the investment and the strong impact credentials, the fund has invested in a green bond with proceeds directly linked to fostering wind and solar energy uptake and scale up clean energy solutions.

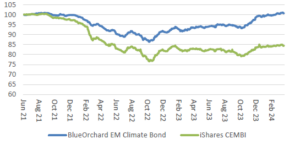

Figure 3: Performance since inception (in USD)

Source: Bloomberg

We have been invested in their Emerging Markets Climate bond fund since its inception in 2021 and we’re pleased to say that it has performed ahead of the wider corporate emerging market debt index with lower volatility, giving a better risk-adjusted outcome for our clients.

Tiziana Maida

Head of Research

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.