Summary

- The global economy remains resilient and, if anything, we have recently seen signs of re-acceleration. Manufacturing looks to be recovering after a tough 2023 and forward-looking survey data is signalling the expansion should continue for the next few months at least.

- This has helped equity markets which had another strong quarter. We currently have a barbell approach to our equity book focused on higher quality structural winners balanced by much cheaper value equities (often in Europe) at the other end. Both made money in Q1. The winners kept winning, while at the same time our value holdings were helped by the improving business cycle.

- However, better economic news means that interest cuts look to be coming more slowly than we thought. Our interest rates sensitive investments, and especially our investment trusts, had a tougher quarter as they adjusted to this new outlook.

- The Bank of England is forecasting to hit its 2% inflation target by the middle of this year and it may even happen in April. The US Federal Reserve has also signalled it is comfortable with the inflation outlook. Central banks have the flexibility to cut rates again as and when the slowdown does come.

- Our fixed income and trust investments look well placed to make money as and when the interest rate cuts come. If not, and the economy remains strong then, as was the case this quarter, equities should continue to deliver.

- Cheaper markets that are more geared to the economic cycle (like the UK, Europe and much of Asia) look well placed to catch up some of their relative losses to the US.

Q1 Review and our Outlook

These are three questions that are front and centre for us as we head into the rest of 2024:

- How is the economy still doing well even after one of the sharpest rises in interest rates in history?

- Will cheap markets stay cheap and expensive markets stay expensive (or put another way, will the US keep outperforming)?

- Where are the best opportunities for the rest of 2024?

The first two of these have surprised many in the investment business. They also provide a good framework to help describe what has been going on in markets for the last 12 months and to give our outlook for the rest of the year.

The current state of the economy

The equity market rally that no one thought possible at the end of 2022 continued in the first quarter of the year. The MSCI World is now up 17.5% for the last 6 months. Europe and Japan are a bit (but not much) below that and the US is (again) a little ahead gaining 19.4% (see Chart 1). The laggard remains the UK up only 6.9% over the period.

Part of the reason for these gains is that, for equity markets at least, no news is often good news. And there have been very few really nasty surprises over the last 6 months. Equities have not only risen, but they have also risen very steadily. The largest daily fall for the MSCI World index this quarter was -1.3% and the index was still up that week.

This is very unusual! It is much more normal to see peak to trough falls of 10% (at least) in any given calendar year. The last 3 months have been exceptionally quiet – I certainly don’t want to jinx it but equally we don’t expect that to continue for the rest of 2024.

The major reason for low equity volatility is that growth remains steady, even after one of the largest rate rises in history. Real incomes are rising again as inflation falls. It looks like the goods market is improving after a tough 2022 (see Chart 2 showing an increase in airfreight traffic as an example). And forward-looking survey data (which asks, broadly, if business is getting better or worse for the companies that respond) is also improving. Generally, a number above 50 is consistent with growth. UK manufacturing PMIs for example – which were screaming recession in 2023 – are back above 50 again.

How is this possible given central banks have been applying the brakes as hard as they can to slow the economy and bring down inflation? I think there are two plausible explanations. The first is that interest rate rises work with a lag and the hit they give to consumers and businesses hasn’t hit with its full force yet. There is some evidence for this: UK mortgage borrowers continue to roll onto higher mortgage rates and we are slowly starting to see an increase in default rates for more leveraged companies. I think Thames Water is probably the start of things to come rather than a one-off, even if it does look to be a uniquely poorly run business.

The other theory is that all this discussion ignores fiscal policy. The furlough scheme handed huge numbers of people (correctly in my view) money for not working. A lot of this was saved and was a cushion to the shocks we saw in 2022.

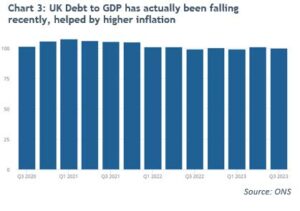

And remember the UK is still running a fiscal deficit of 5.8% of GDP (the US deficit is similar). That is a lot of support for an economy that is doing OK! One legitimate worry is that government borrowing will spiral out of control and be the root of the next global crisis. We are keeping an eye on this but for now it is worth pointing out that UK debt to GDP is actually falling rather than rising (see Chart 3). This is the one “benefit” of inflation of course. And, unlike other countries, UK borrowing tends to be long term (10 years or more on average) meaning that interest rate rises only feed slowly into UK government borrowing costs. If the UK does have a debt crisis it is likely to be a slow burner that puts a squeeze on government spending rather than a sudden stop.

Why has the economy been so resilient to interest rate rises so far? I respect the view that the interest impact is lagged. This certainly looks to be true for companies and is slowly coming home to roost today. But remember the Liz Truss crisis was now 18 months ago, wages have been rising strongly and energy bills are coming down. It is hard to believe we are in a worse place than we were in September 2022 and the economy hung in after that with unemployment remaining low. Fiscal support remains in place. I feel more optimistic about the next 18 months than I did about the last 18. And, with my investment hat on, though equity markets are normally bumpy they are also normally good places to invest when the economy is expanding. I feel like the last 6 months have seen a pretty exceptional run but there is still reason for optimism for the year ahead (see Chart 4).

Cheap markets vs expensive markets

If this is the economic backdrop, then the other notable feature of markets has been the continued gap between cheap regions and sectors (like the UK of course) and the more expensive US market. People like me have, of course, been writing about this valuation gap for 10 years or more, but it is worth pointing out that the US is trading expensively relative to its own history whereas European equities (after the rally of the last 6 months) now look fairly valued (see Chart 5).

The valuation gap is, of course, down to the fact that markets are convinced that Artificial Intelligence (AI) and software will continue to reshape the world we live in. The (expected) winners of AI are largely in the US. The losers will, I’d guess, include plenty of the cheaper companies listed on UK and European exchanges. But markets also have a history of over-reacting. Investors in the 2000s dotcom bubble – correctly! – predicted the rise of the internet. But those who invested near the top had a tough few years. The US Nasdaq market ended up taking 15 years to get back to its peak of March 2000.

We are believers in the continued growth of software and AI and are reluctant to bet against any long-term structural trend. But equally we just cannot avoid investing in some of the cheaper and unloved opportunities we see. The equity strategy therefore remains:

- Own the whole market as cheaply as we can (via ETFs) as our core equity investments. One advantage of this is that we own all the US technology giants (at their market weight of course). So, when Nvidia triples in value (as it has done over the last 12 months) we capture our fair share of this. I’d also add that this “own the market cheaply approach” means we are also maximally diversified and so own plenty of the cheap and unloved (UK banks, mining companies and China for example).

- On top of this we have an allocation to managers who own what we think of as being structural winners. This will include US technology companies of course but it is also worth remembering that Europe has winners too. Europe dominates luxury goods with Hermes and LVMH being the most prominent examples. Both of these continue to grow with their remarkable profitability being unaffected. And the recent weight loss wonder drug, Ozempic, was created and is made by a European company (Novo Nordisk).

- That said I wrote 6 months ago that Barclays bank was trading on a 4 times prices earnings (PE) multiple and had a 15% total cash yield (dividend plus share buybacks). Parts of the UK market look just too cheap to ignore! The UK market forward PE multiple still trades close to its all-time lows and there are plenty of cheap looking opportunities in Europe, Japan and the Emerging Markets. It is possible that the market (as it often does) is right directionally but is just too optimistic about all things AI. We therefore balance our allocation to structural winners with an allocation to the cheaper, value end of the market.

For the last 6 months this has, broadly, worked well. The US and all things technology have continued to lead the market. Meanwhile, much of what is cheap is also cyclical. As the economy has improved, the rally has broadened and our value equities had a decent first quarter. Our barbell approach of winners and the unloved has worked for the last 12 months and we see no reason to change it for the rest of 2024.

Where are the opportunities?

I have mentioned above cheap and unloved Europe. We recently invested in a manager owning good quality names trading at a weighted average price to earnings ratio of around 8 times. Not much has to go right I think for this to be a good long-term investment (though, as is ever the case, a lot can happen in the short run). The other area I would highlight today is businesses that are feeling the squeeze from higher interest rates. This includes many smaller and medium sized companies. Also included, very obviously, is commercial property.

Many Real Estate Investment Trusts (REITs) are trading at large (25% or more) discounts to their Net Asset Values. One high conviction idea I do have is that if you are going to buy a property (with all the work and costs that entails) take a look at the REIT market. Here you can buy a diversified portfolio, get a big discount on the purchase price and pay no upfront fees to do so. Of course, because you are buying an equity, you pick up the short-term ups and downs of the equity market. But we see a number of higher quality REITs yielding 7.5% or more today with some inflation protection and low leverage levels. Many of our clients want to beat inflation with a sensible margin over the longer term. With today’s discounts, higher quality REITs look like they are priced to do this over the longer term.

The other feature of REITs (and the broader investment trust market) is that they have been trading in line with interest rate moves. As interest rates have risen, they have fallen, and vice versa (see Chart 6). If the impact of higher interest rates does hit the economy with a lag in the second half of the year then we would expect the Bank of England to be able to cut rates pretty quickly (CPI inflation may hit their 2% target this month). If that happens then interest rate sensitive stocks should be winners, in relative terms at least. We have, of course been wrong about all this so far this year. Our growth sensitive assets (mainly equities) have done well and our interest rate sensitive ones (like investment trusts) have fallen in value. We wouldn’t be surprised if this gap in performance closed some time in 2024.

Chris Brown

Chief Investment Officer

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.