You are dealt a certain hand of cards in life and I have no complaints about mine. But I think my hand is probably well suited to writing things down. Or, to put it another way, I’d think I’d have a better career in radio (or podcasting) than I would on TV. If you are not sure what I am getting at here, my final clue is that I was very heartened this week to see research showing that – using deep learning (?) to quantify facial attractiveness – unattractive managers outperform funds with attractive managers by over 2% per annum. Clients of IPS, you are in safe hands.

I’ll return to my usual review of the data and markets next week. But this week, as we are approaching Christmas, I thought I’d step back and look at some of the bigger picture trends and charts and throw in a couple of startling (to me at least) market facts with which you can entertain (or not) your guests this holiday season. First, three charts.

- The post-Covid recovery has been unique and this cycle certainly feels different to those of the past. However, I was surprised to see that US equity markets are actually having a very normal recovery from an inflation peak (the chart below uses data going back to the 1950s). If nothing else, this makes me more bullish about the year ahead.

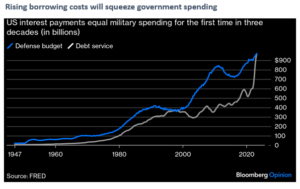

2. Looking forward, I think one theme will be rising interest payments putting pressure on government spending once again. For once, the UK is actually relatively well placed here as much of its borrowing is long term so interest rate rises will only bite slow. For the US, which borrows more shorter term, the effect will be more dramatic. For example, here is debt interest and defence spending as a percentage of GDP.

- Finally, you’ll often see me writing here about the US more than the UK and Europe. This is why it remains the most important market to try and get right:

And here are my three market facts that will make you a more popular and interesting person this Christmas:

- If you had bought Apple stock instead of every new-issue iPhone along the way, today you would have around $147,000 in your trading account.

- Since 1992, Chinese GDP is up 46 times. By comparison, US GDP is up just 4 times. Over the same period, the total return of China A-shares is up 6 times. By comparison, the US S&P 500 is up 19 times. So, despite having over 11 times the GDP growth, Chinese stocks have generated less than one third of the return. Faster GDP growth does not mean faster equity returns!

- The best tennis players of all time only win about 54% of total points. The best investment managers probably have a similar hit rate – please bear this in mind as I make my forecasts for next year.

Thanks to Tony Pasquariello at Goldman Sachs for these. Normal service will be resumed next week. If nothing else, this was a busy (and generally positive) week for European data and I’ll have an update on that.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.