I am away on holiday this week. This time – and this has not always been the case in the past few years – the markets have stayed well behaved and I have been able to actually enjoy some time away with the family. Indeed, the year so far has been a good example of equity markets “climbing the wall of worry”. Neither higher interest rates, still above target inflation, nor failing banks have done much to de-rail the idea that the economy is holding up much better than many thought possible a year ago. To that end I thought it would be good to reprise a weekly note I wrote in November last year. It asks the question should you buy if the newspapers (and specifically the Economist magazine) are shouting sell? When the Liz Truss crisis flared up in September last year this proved to be pretty solid advice. Time will tell if there are more opportunities to act on it in 2023.

IPS Note, 18th November 2022

One well known aphorism in investment is that when something or someone makes the cover a magazine, be inclined to do the opposite. The Economist has a particular track record for this. Here are a couple of covers from 1999 and 2003 when oil was trading at around $20 a barrel. 5 years after the later one oil peaked at over $140 a barrel.

Here is another one from Fortune magazine from earlier this year. This is Sam Bankman-Fried, the man behind the bankrupt crypto exchange FTX which owes customers around $8bn in deposits. He was not the next Warren Buffett.

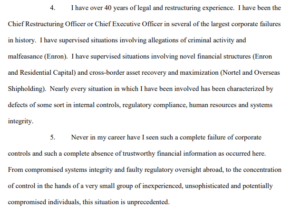

It is worth noting that part of the problem here was that the venture capital industry showered people like Bankman-Fried (and Elizabeth Holmes of Theranos fame) with huge amounts of money and very little oversight. Some of the biggest names in the venture world, including Tiger Global, SoftBank and Sequoia Capital invested around $1.8bn in FTX. The company had no board, no real audit and few, if any, internal controls. And it was a finance company not, say a maker of games or social networks. Yesterday, John J. Ray III, the new CEO of the now bankrupt FTX, gave his first declaration to the bankruptcy court in Delaware. It included this passage:

FTX will be a watershed moment for the crypto industry. If the industry survives, whatever comes after will have to be different to what has gone on before. But the general backdrop here is a visionary founder showered with money and media attention and very little oversight. There have been plenty of these founders over the last few years. We hope that FTX will prove to be the worst of the start up bankruptcies, but we will be surprised if it is the last.

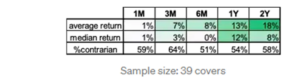

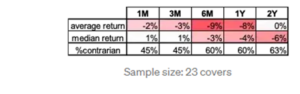

More generally, though, is the magazine cover really a contra-indicator or is it just a fun way to sound clever when reading the Economist? Thankfully, Brent Donnelly has crunched the numbers. He looked at Time magazine and the Economist (Barrons does not really work as it is always about financial markets and is generally bullish). Here are the results:

Asset performance after a bearish magazine cover:

Asset performance after a bullish magazine cover:

So there is some evidence that magazine covers are indeed a good contra indicator! The Economist, it turns out is a very good contra indicator for commodities but less so for currencies. Bubble stories should also be taken with a large pinch of salt (four are below as an example).

These covers of course mirror the emotional/behavioural side of investing. Fundamentals are good, markets are going up, you feel bullish and read bullish stories. Fundamentals are bad (today!), markets are going down and there is of course a market for bearish stories and headlines. Generally, though, the second environment is the better one when you are thinking about your future long term return prospects.

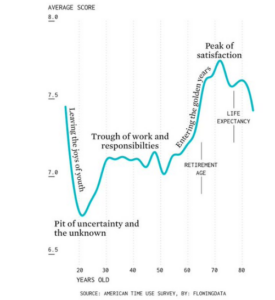

Finally, some good news, for me, a 52 year old. Here is a life satisfaction curve by age based on the US time use survey. It turns out the 52 is the nadir of life satisfaction for people over 30 and it is only up hill for me from here. I just hope that, whatever the data and magazine covers say, the same is true for you, especially if you have the misfortune not to be 52.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.