So the Chancellor did indeed introduce a ‘British ISA’. It was small (£5k per person) and will probably have a very limited impact as (i) most people do not use all their ISA allowance anyway and (ii) it’s not clear today how much you will be able to use this to shift existing holdings around and how much will be actual new investment. That said, UK markets did get a small shot in the arm and (as I type) the UK FTSE 250 mid-cap index is the best performing major market this month. Long may it continue!

But as I wrote earlier this week, it is underlying corporate performance that really matters. I have shown versions of the chart below before, but here is UK vs US relative performance since 1990. Nearly all the (very considerable) under-performance of the UK equity market comes from the fact that UK companies have consistently generated lower profits than their US counterparts in aggregate. It is this that needs to change (not tax breaks for investors) if we are to see the re-awakening of UK plc.

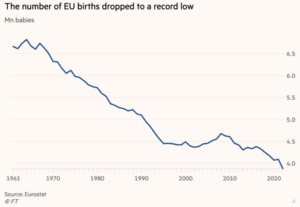

One cause of low growth economies can be (as Japan has shown) aging populations. Whatever you may think of today’s high immigration levels, they do help keep the workforce younger. And it is clear to me that many countries continue to need this shot in the arm. Birth rates in many parts of Asia (South Korea especially) are shockingly low. Data in this week’s FT show that the Eurozone also has this problem. It is ultimately the working age population of every country that keeps the whole show on the road.

US demographics are not that great either, but they continue to be better than many other parts of the developed world. This is helping US exceptionalism (in an investment sense) to continue. However, it is really the performance of the US’ seven largest companies that has been truly exceptional. I have had questions from clients who worry that the US technology sector is once again very bubbly. To this I would counter that, once again, it looks like superior profit growth is the real driver of the out-performance story. These companies have been able to grow earnings materially faster than the rest of the US market for several years now. As long as they can continue to do so, they will trade at a (deserved) premium to the rest of the world.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.