For much of the 2010s central banks kept cutting interest rates and buying bonds to try and pump money into the economy to boost growth. Yet you saw very little reaction to all this in the real economy: growth and inflation trundled along in the 2% zone until Covid came along and upended everything.

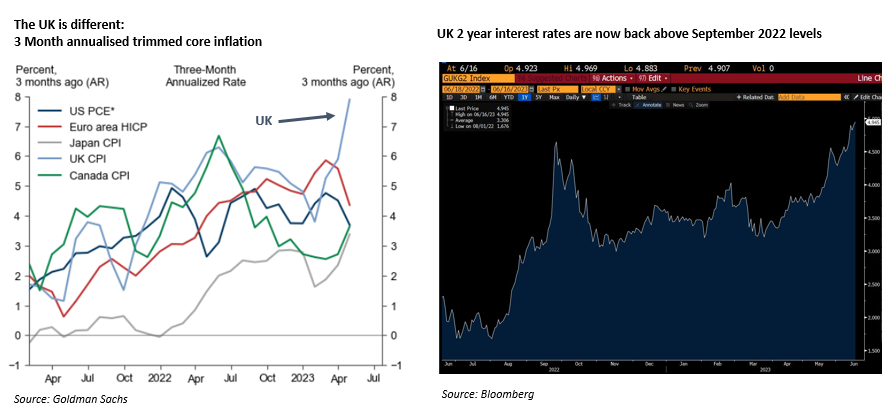

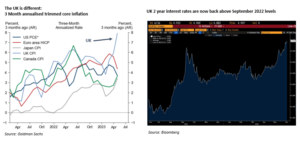

This year we have, I think, seen the opposite. Interest rates have rocketed from 0% to over 5% in the US and the economy is still running along as if not much has happened. The other surprise for investors is the economy where higher rates should on paper have the biggest impact – the UK – is also the one with the most persistent inflation problem. All this has led to a situation where 2-year interest rates in the UK are now above where they were after the Truss/Kwarteng mini-budget last September.

Does this mean Truss was right after all? The analogy I would use here is the Bank of England is hitting the brake to slow down the economy and cool inflation. The Truss budget was effectively the government pressing hard on the accelerator. This didn’t make much sense and markets and politicians rightly forced a U-turn. Well, the Bank of England is still applying the brake hard and, 9 months later, the economy is still growing and inflation and wages remain strong. Interest rates will keep climbing until we see the sort of cooling in inflation we are starting to see elsewhere.

The other big difference between now and 9 months ago is, of course, equity markets. Equities are rising this year having fallen for most of 2022. Equities spent much of 2022 fretting over the next piece of inflation data. Nasty inflation surprises meant large equity falls. The difference this year is that inflation in the world’s largest economy – the US – looks to be behaving pretty well. The goldilocks scenario of inflation falling without unemployment rising remains intact. Monthly US inflation data came out this week and it continued to fall.

Just importantly, many measures that strip out the most volatile and lagging inflation components (including services inflation and so called “super-core” as shown below) are now within the Fed’s targets. Equities are trading as if inflation was a 2022 story. Economic stability and the rise of Artificial Intelligence (AI) are the themes for 2023.

Where the US goes, the rest of the developed world tends to follow. I continue to believe that this will eventually be true for the UK inflation picture. This means we continue to like bonds here. Not only because of the yields on offer (back over 6% for shorter term investment grade) but also because they look to be a good place to be if and when the US goldilocks story starts to unravel.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.