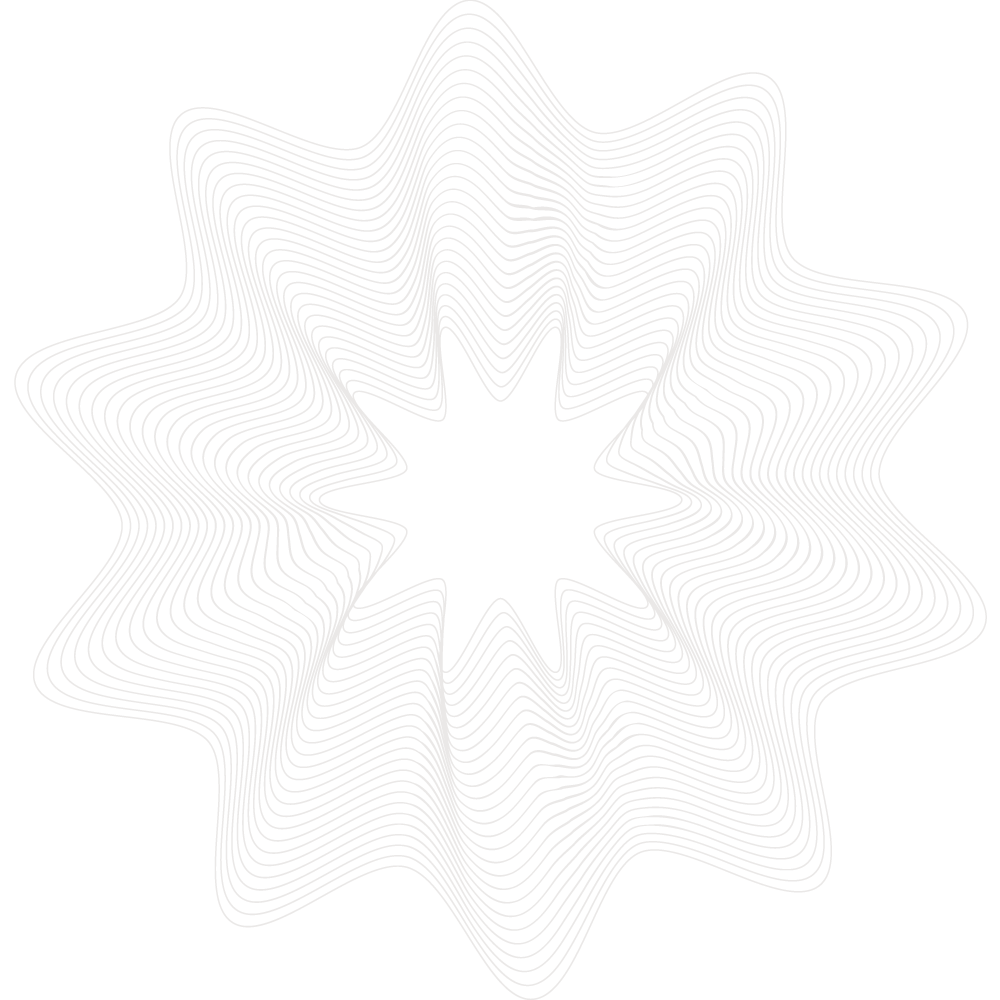

This is my last weekly note before my summer break. I therefore thought I’d look back on the year we have had so far. I often use the chart below as a basic (top down) framework for clients. We think we have three basic scenarios to worry about today. Inflation, which has been rare for the last 20 years but when it arrived last year was very nasty. Recession (which happened in 2008/09 and briefly in 2020) and then something in between. I have called this Soft Landing here, but you could equally call it Something Else or a regime where the economy is broadly stable and growing.

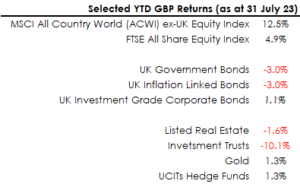

So far, this has been the year of the Soft Landing. Traditionally risky investments (like equities and riskier corporate credit) have done well. Safety and security have been punished. To illustrate this, year-to-date returns (to end of July) for sterling investors are below. UK equities are up 4.9%. Global equities, driven once again by the US technology sector, are up 12.5%. In contrast, UK government bonds (in spite of today’s higher yields) have lost money. Corporate credit (which is a little bit riskier) is up a bit. In the alternative space, the often defensive investment trust market has been hit by sharply rising UK interest rates.

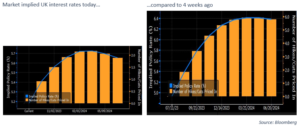

On this last point, we finally saw some cause for optimism for UK interest rates (and mortgage borrowers) this week. Following a soft inflation report in July, the Bank of England raised interest rates by only 0.25% on Wednesday, less than the 0.5% some had feared. The peak for UK interest rates is now expected to be around 5.75%. This compares to an expected peak of almost 6.5% just 4 weeks ago. This is a big shift in market expectations! This should provide some support for the UK fixed income and investment trusts markets.

Where do we go from here? Our best guess is that inflation will continue to fall for the rest of 2023 and we are at – or near – the peak in interest rates for this cycle. This should help our bond investments (which currently yield around 6%) to generate some positive returns. Defensive equities – like investment trusts – should also start to find a bottom helped by today’s much higher starting yields.

There are 5 months left of the year. It wouldn’t surprise us if some of the losers so far year to date start to recover some of their losses. As for equities, inflation needs to keep falling without triggering a meaningful slowdown in growth. So far in 2023, the global economy – to the surprise of most pundits and economists – has been able to pull this trick off. It would be good if it could keep on this track for my summer break at least.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.