Equity markets have (and continue to be) stronger and less volatile than many of us thought possible at the beginning of the year. There is no doubt a myriad of reasons why, but one thing that has surprised me has been how resilient businesses and consumers have been to the various shocks (Covid, interest rates, energy) that have been thrown at them in the last few years.

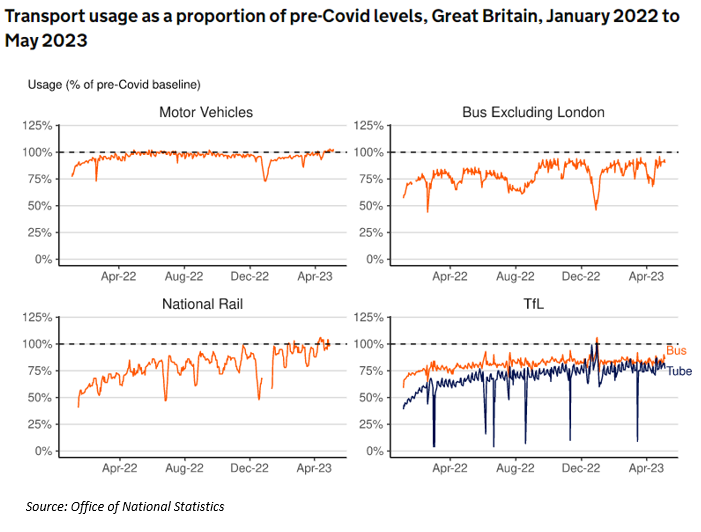

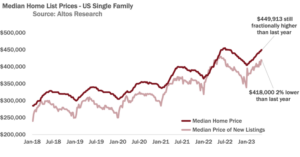

On Covid, I won’t have to tell those of you who squeeze onto a train every day that National Rail transport usage is now back to (or slightly above) pre-pandemic levels. The recently released Office of National Statistics transport data is in the charts below. While cars and rail have fully recovered, London bus and tube usage is now running at roughly 80% of its pre-Covid number. Part of this decline will be down to hybrid working (which looks to be here to stay), but even there you can see the usage number slowly drifting back up as (I would guess) working from home numbers slowly fall.

On interest rates, we estimated back in September last year that a rise in mortgage rates from 1.5% to 5% would increase a first-time buyers mortgage payment by 45% and that house prices would need to fall by about 30% to be consistent with today’s mortgage affordability. Now, this estimate will probably be on the high side as it ignores the deposit component of a house purchase (unaffected by interest rates) and it ignores people who buy without needing a mortgage at all. Still, higher interest rates should mean lower property prices.

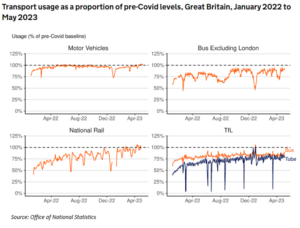

And indeed, house prices have been falling in the last few quarters. But it is interesting that they look like they might be starting to recover again. Some recent US data is shown bellow. US house prices are down year on year but are rising again this year.

Of course, what really matters are real (inflation adjusted) prices. What can happen in less liquid markets like real estate is that prices don’t move much over long periods of time, but the impact of inflation slowly eats away and makes property cheaper in real terms. This looks like it might be happening in the UK. Using the Nationwide house price index, house prices are now below where they were 5 years ago after adjusting for inflation. They have also fallen by almost 15% in real terms in the last year.

The positive surprise for me is that this has happened without much stress in the banking system or the real economy. Which brings me finally to energy. Oil continues to trade below $80 a barrel and UK gas prices and electricity prices are continuing their steep falls (see below). This will be a particular boon to UK businesses which received very little subsidy from the UK government to shield them from the impact of energy price rises. Still, this policy will have forced more efficient energy usage and so will have helped contribute to the falls we are seeing today.

All these adjustments have happened with growth remaining strong and unemployment being at or close to all-time lows. This has been a pleasant surprise. It may yet be that people and businesses have eaten into their savings and as these savings run out, the impact of interest rate and energy costs will finally show up in the real economy. But last year’s headwinds are becoming this year’s tailwinds. As inflation falls, so real incomes rise. Energy costs are falling sharply for business users and we may be nearing the peak of the interest rate cycle. Equity markets may not be so irrational after all.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.