My daughter is still (just) young enough to be half dreading, half looking forward to going back to school. My gut feel is these coming weeks (at least after the US Labour Day holiday) will also feel very back to school for markets.

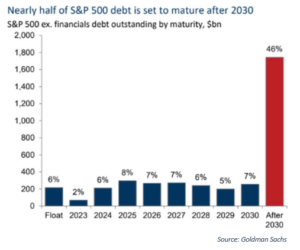

There has been a tension all year between the pressure that higher interest rates are putting on certain parts of the economy and the surprising strength of the rest of it. Part of the reason for this is that raising interest rates has some unexpected effects, especially for many larger businesses. As an example, here is the debt maturity profile for companies that are in the US S&P 500 equity index:

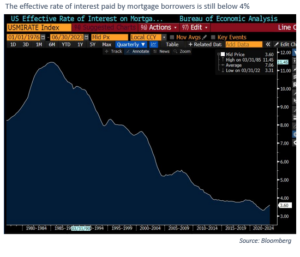

Take Exxon as an example. It has $36bn of longer-term debt and $30bn of cash on hand. As interest rates raise, Exxon makes more on its cash than it has to pay out as interest on its debt. Slowly, this process will reverse as Exxon refinances it’s debt at today’s higher rates. But you can see from the graph above this process will be slow and nothing much will change for Exxon (and many others) over the next couple of years. Similarly, here is the average interest rate paid by US mortgage borrowers:

You can just start to see the effect of higher interest rates feeding through but US mortgages are generally 30-year fixed rate. The uptick you can see is just the impact of new borrowers borrowing at today’s rates. Older borrowers (the vast majority) are still living like its 2020. For sure, the impact of rising mortgage rates will be felt quicker in the UK (where mortgages are generally fixed for 5 years or less) but a third of UK homes are owned outright. Homeowners without a mortgage are also likely to be benefitting from higher cash deposit rates.

These effects mean the impact of rising interest rates has been less than many expected. The media also tends to focus on the losers (heavily indebted borrowers) rather than the winners (those without debt and/or plenty of cash). Still, we think this impact will eventually show up in the economy and the place that looks the most exposed today is Europe. Some very gloomy survey data (consistent with recession) came out for Germany last week. UK house prices also fell by more than expected today and slowing housing activity is usually associated with a slowing economy.

We continue to think that our more defensive positions (including our fixed income and infrastructure investments) will be well placed as and when the slowdown comes. But every day is a school day. The resilience of the economy so far has been, in aggregate, a pleasant surprise as has the strength of equity markets.

I hope my daughter continues to pay attention and learn this autumn. Her father will try and do the same.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.