Probably the biggest disappointment for investors so far this year has been China. At the end of 2022, being overweight China as it (finally) released all its Covid restrictions felt like a pretty attractive trade. And why not fund it from (expensive) US equities that looked primed for a slowdown after one of the fastest and sharpest interest rate rises in history? Well, the US market is up 10% year-to-date, and the Hang Seng is down -4%. The question for Chinese investors is stick or twist?

I was thinking about this this week when I read a great paper by Jason Hsu of Rayliant. Emerging Markets – in spite of all their promise – have underperformed for the last 15 years or so. He summarises three main reason why:

- Inconsistent growth: Part of the appeal of investing in Emerging Markets (EM) is, of course, access to faster growing economies. In reality the record here has been pretty patchy for EM. Parts of Asia (and especially China) have delivered. But Eastern Europe, South America and Africa have not. You needed to be in the right spots, and a broad allocation to EM has probably not delivered the higher growth you were after.

- Even if you got the economic growth, this does not always translate into higher earnings for investable companies. The fact that there is not much of a link between GDP growth for a country and equity returns for its investors has been well known for a while now (for example, see Ritter 2005). The other problem has been that even where economies grown fast, much of the money that has been made has been in private, unlisted companies not accessible to public market EM investors. The incumbent state-owned entities that dominate the listed equity markets have just not been a great place to invest in.

- Finally, you have not had the diversification you would have hoped for. One of the attractions of EM investing was diversification away from the challenges Europe and the US faced. In reality, a large part of EM is geared to commodity cycle and so the broader global economy. This has often made EM feel like a higher risk play on global equities, rather than the diversifier it is supposed to be.

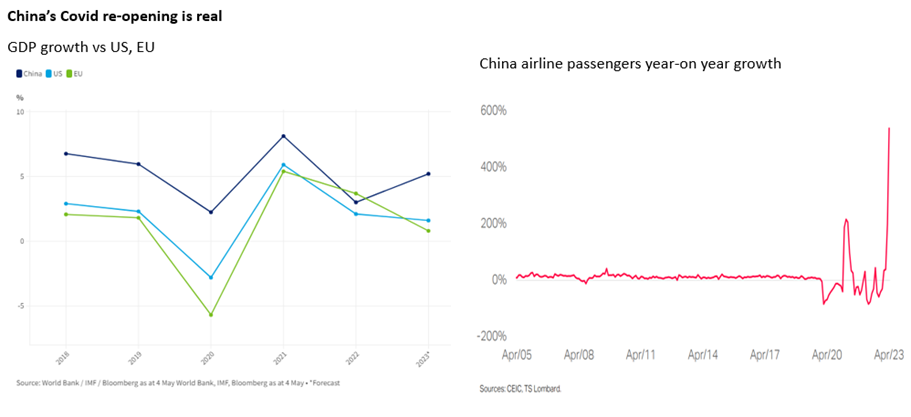

How does China today stand up to these criticisms? Well first, the growth story does look to be there. The impact of Covid re-opening on the economy is real and substantial. Chinese growth is expected to be north of 5% this year and there is clear boom in the service side of the economy (including air travel).

Secondly, it is worth noting that the one country that has been able to combine high economic growth with high growth in corporate earnings (what you are looking for as an EM investor!) has been China. The table below shows GDP growth and earnings per share growth since 1996 for selected EM countries. China is the one country that has delivered on its promise.

Finally, it is worth remembering that, whatever you think of China’s broader strategic challenges, it remains both cheap and big. China is 16% of global GDP and the second largest equity market in the world by volume. After its recent falls, the China Hang Seng index is now trading at a price earnings ratio of 10x which is cheap both relative to the MSCI world index (which trades at 16.5x) and to broader EM (12x) and to its longer-term history (see below).

So: stick or twist? For the traders out there (time horizon of the next 3 months) I am afraid you were wrong. The re-opening catalyst has happened and the market has not responded. Time to move on to the next potential recovery story (Japan?!)

We are, however, not traders and for longer term investors the story is more balanced. The three big challenges for China remain in place: property debt, poor demographics and de-globalisation. But remember Europe last year? It was buckling under the weight of crippling energy prices and inflation. However, the cheap prices on offer meant that when these risks receded we saw a nice bounce in European equities and investors were rewarded for their patience. China looks to be similarly fairly priced today for the risks you take on. The fact that China does not have an inflation problem means it may even have some sort of diversification value. Whilst we do not have a large position in client portfolios, we are happy to keep our allocation on today. If the bad thing does not happen, there is a good chance investors’ patience will ultimately be rewarded.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.