It was a big week for those of us with mortgages. The Bank of England met on Wednesday and it looks like the first interest rate cut will now be in June (with a 1 in 3 chance it comes earlier in May). Cuts totalling 1% are priced in for the next 12 months and my best guess – assuming the economy stays stable – is that the UK terminal bank base rate will be around 3% by the end of 2025. But, of course, life is uncertain. Feel free to disagree. And if you do have a strong opinion on this I think commercial real estate is a good way to make money today if you are right.

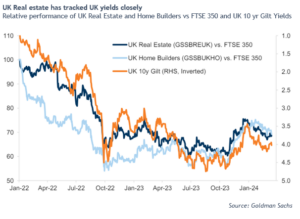

There is clearly much less leverage in property markets than there was in the 2008 crisis. The fact that rates have risen from zero to 5.25% and there haven’t been widespread defaults and forced sales speaks to that. But, that said, the economic pressure of higher rates is still felt keenly by the property market. The chart below shows that UK real estate and home builders have been moving with the interest rates (here shown as the 10 year gilt yield) very tightly since 2022.

This means that if you have the view (as I do) that interest rates will slowly continue to fall from here then real estate could be an attractive place to be. It should also be a good diversifying bet. Equity markets have been led by all things AI and US and technology. Having a potentially attractive money maker that is unrelated to that feels attractive to me today.

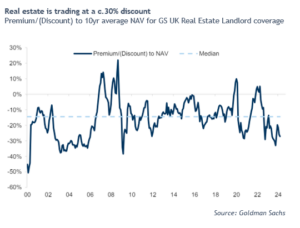

The other point to make here is that I think you are much better off today buying real state in public markets than buying direct physical property yourself. The logic here is pretty simple. It takes time and money (including agent fees and taxes) to buy a physical building and you’ll have to pay close to the full asking price. Alternatively, you can buy shares in a real estate company instantly and get a 30% discount off today’s valuations. And today’s discount to net asset value is near the lows for the last 20 years.

So, I think real estate looks like an interesting opportunity here. But one sector that looks just too hard to call for me is the office market. We have seen a slow back to work trend for most companies, unemployment is low and the economy is growing. We should be seeing the picture slowly improve for the office market. In fact, office vacancies are near 20% and are as high as they have ever been in recent history. Nor is it easy to convert office space to residential (say) without knocking the building down and starting again. The vacancy data below is for the US but the UK looks pretty similar:

20% vacancy rates suggest we have too many offices on our hands, which rarely makes them a good investment. So, it is commercial property ex-offices that looks like an interesting investment to me. All this is predicated on mortgages coming down of course. If they do it should be good news not just for this kind of investment but also for all us mortgage borrowers out there. We shall see.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.