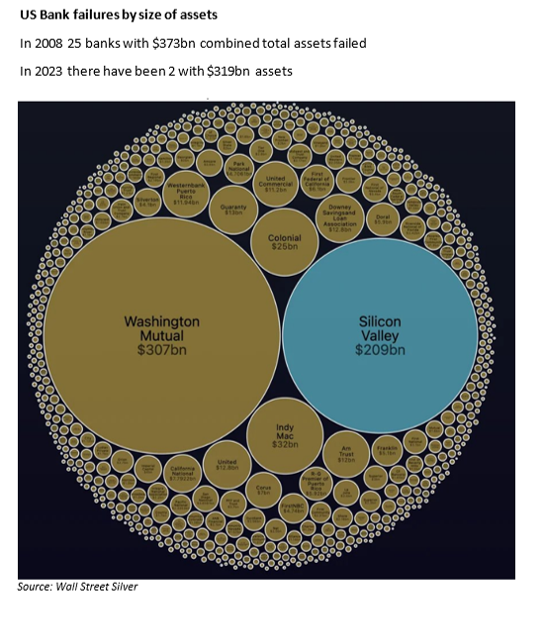

Well, a lot can happen in a week. Since I last wrote seven days ago two US banks have failed, one of which is the second largest bank bankruptcy in US history (see the infographic below). This has meant that US interest rates, which were expected to peak near 6% a week ago, are now only expected to rise to 5%. This is one of the sharpest falls in rates markets we have seen in recent history. The 1987 stock market crash, the 9/11 attack and the dark days of 2008 saw bigger falls, but even to be in that company shows you the week we have had. What you do not want to see at times like this is the bad news spreading. Step forward Credit Suisse, which seems to have stepped on every financial landmine in the last few years. Its bonds and share price collapsed last week. The market – depending on where you look and which assumptions you use – was pricing in around a 50% chance of a default for Credit Suisse this year.

So that is the news flow. Phew. What does it mean for markets and your investments? Here are my three immediate takeaways from this week’s events:

1. The first point to make is that the equity market reaction (unlike bonds) has so far been pretty muted. US equities are down 1.2% in the last 5 days. Bond markets (because interest rates have fallen so sharply) are actually up more than that so balanced investors are holding up OK so far. Why is that? One reason is that each crisis is – almost by definition – different from the past. Banks were at the centre of the 2008 collapse. Since then we have seen tighter regulation, higher capital requirements and better plans for what to do if they run into trouble. Some of these plans have been executed in the last few days. Deposits in Silicon Valley and Signature bank have been guaranteed which is helping reduce the risk of deposits fleeing small lenders.

More creatively, the Swiss central bank has agreed a CHF50bn funding line with Credit Suisse. It plans to buy back its own bonds which are trading cheaply. Borrowing 100 from the market and then buying the debt back at 70 is a profitable trade! Talk does not help much at times like this. The sort of banks that say there are no problems, everything is fine tend to be the sort of banks where there are problems and everything is not fine. Buying back your own debt with the help of the regulator is much more effective. Credit Suisse shares are up almost 50% from Wednesday’s lows as I write.

2. That said, if interest rates fall that is because bond markets expect to see growth fall. Once again, we have optimistic equity markets pitted against pessimistic bond markets. One impact of this week is that smaller banks will be under pressure to raise some capital and be more conservative with their lending. This will add more pressure onto borrowers already struggling with one of the fastest and largest rises in interest rates ever. This extra pressure is why bond markets now expect rates that need to rise by less in the future.

I would not want to go out on a limb here and say who I think has it right. All I would do is contrast the last few days with the worst days of 2022. There it was rising inflation and rising interest rates that were forcing most other asset classes down. Bond markets and equity markets fell together. We have been adding better value bond positions to our portfolios over the last few months precisely because we were worried that growth would slow. These duly made some money this week. The future is often unknowable. But our portfolios look to be in a better place to weather, whatever the rest of 2023 has to throw at them.

3. Finally, a word on Europe. A theme of some of my notes this year has been the opportunity we see in the UK and European equities. One reason we have not been more aggressive adding to these positions is the realisation that European equities tend to be more vulnerable to growth surprises. We saw that again this week as Credit Suisse dragged European banks and European markets lower. The Eurostoxx 600 market has fallen by 3% more than the US S&P 500 by over the last few days.

We would need to be more optimistic about the growth outlook to take the plunge here. One final place to look for signals is, of course, commodity markets. These were rising fast and flashing red about inflation in 2021 and 2022. A barrel of Brent crude oil went from $50 a barrel at the start of 2021 to over $100 in early 2022. Today (even after the impact of Russian sanctions) Brent is trading at $75 and falling. US produced oil is below $70. This hardly smacks of economic growth running too hot. Commodity markets are also arguing for us to exercise some caution here.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.