IPS did their annual volunteering day at an urban farm in Spitalfields yesterday. As I was mucking out the donkey stables, the staff told me that the one reason the farm exists at all is that there are crested newts that live naturally on the farm and you are not allowed to disturb their natural habitat. Building on a small, crowded island where there are plenty of conservation laws and local interests isn’t easy. I have shown the chart below before and the message I normally give is that residential property prices need to fall more to adjust back to a world of 5% interest rates. But it is worth remembering that building in the UK is hard and the supply of housing remains restricted. This will help keep residential property prices elevated.

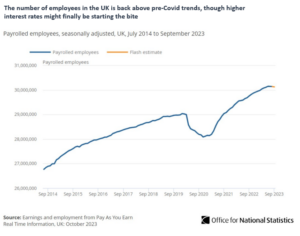

The other part of the story is that the demand for housing remains strong. I was reminded of this by the latest employment data released by the Office for National Statistics (ONS). The chart that really caught my eye is below. It shows the total number of payrolled employees in the UK over the last 9 years.

There are a few reasons why I think this is an interesting way to look at the UK economy. The first is that the initial 2016 impact of the Brexit vote is barely visible here. There is certainly little evidence of employees leaving the UK as it is a less open friendly place to work. Immigration is partly behind this growth in employee numbers and net immigration levels have been rising again recently.

Secondly, this is (roughly) a 13% growth in employee numbers since 2014. In the 9 years since June 2014 the UK has grown by (only) 14%. So nearly all GDP growth has come from employment growth. Where is the productivity growth?! One of the mysteries of today’s economy is that we are being told (and I can see) the impact of software and technology improving businesses and processes. The problem is you can see these improvements everywhere apart from in the productivity numbers (and, by extension, GDP growth).

Finally, you can see just how strong the post covid-rebound has been. Employment levels are now back above their pre-covid trends. The strength of this growth is one reason why the Bank of England has felt the need to raise interest rates so sharply. You can also see (just) start to see the impact of these rises in the latest flash estimate (shown in orange and which is starting to fall). Falling employment means rising unemployment. This is one reason the Bank of England didn’t raise rates in November and our best current guess is the next interest rate will be down not up.

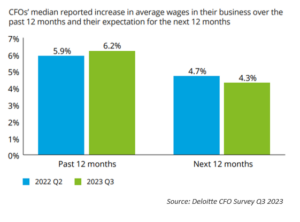

Another reason to think this might be the case came from the Deloitte quarterly CFO survey also released this week. It shows expected pay rises for the next twelve months to be 4.3% (and falling from 3 months ago) compared to over 6% for the trailing 12 months.

All this points to a slowing economy where high quality fixed income investments yielding 6% (or more) look to us an attractive place to be. But the strong growth in employment numbers (and the newts) should give some cushion to residential property. House prices need to adjust further now we are back to a world of 5% interest rates, but, as has often been the case in the past, this adjustment might be less than first time buyers are hoping for.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.