2022 was a very tough year for investors, with bonds and equities both falling in tandem for much of the year. September has had echoes of that. Surging oil and falling sterling helped the UK FTSE 100 index be the month’s best performer. Otherwise, global equities are down 4.8% in dollar terms. A 5% fall in equities is, to be honest, something that happens a few times a year as standard so would probably barely warrant a mention in my normal weekly note. What has been unusual though has been the recent moves in bond markets.

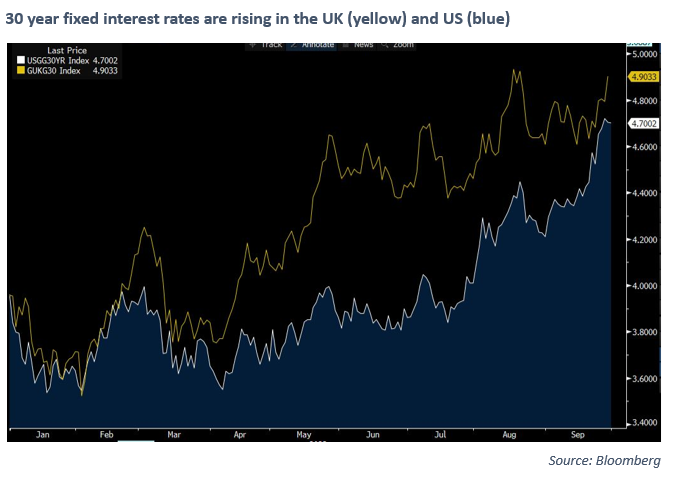

As I wrote last week, it looks like the peak for interest rates is in at 5.5% in the US and 5.25% in the UK (with maybe a chance of one more rate rise to come). This should mean all calm for bond markets, right? The finesse here is that there are really two sorts of interest rates that affect people. First, there are short term interest rates which the Bank of England are – more or less – the cash deposit rate a competitive bank would offer you. However, many businesses and mortgage borrowers borrow at longer term fixed rates. These are less directly under central bank’s control and it is here were we have seen some real volatility in rates. As an example, here is the 30-year fixed interest rate in the UK (yellow) and US (blue) for the year to date:

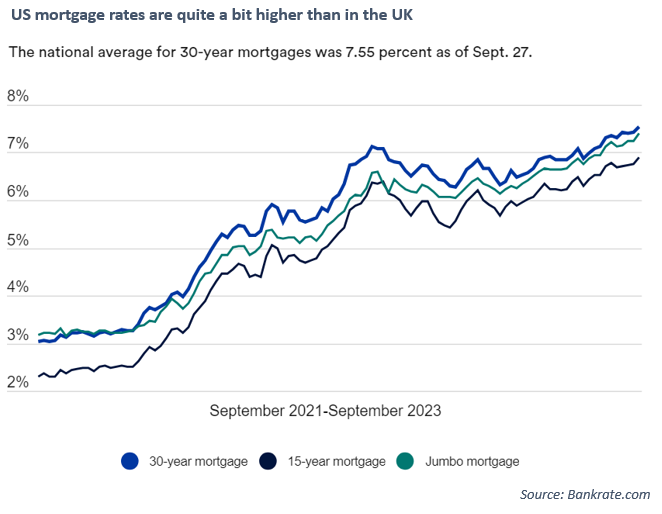

This is a rise of over 1% from April’s lows, and much of this happened in September. This is particularly relevant in the US where most mortgage borrowers have 30-year fixed rate (prepayable) mortgages. The rate on these is now over 7.5% in the US (having risen from 3% at the end of 2021). This is quite a brake for the US housing market and it is continuing to be applied.

So, even though (floating) bank base rates are probably as high as they are going to get, interest rates for many fixed rate borrowers still rose sharply in September. The squeeze in incomes also remains on. And you can add rising oil prices to this squeeze. The extra money it costs to refill your car will, in all probability, mean less money to spend elsewhere. This was, of course, the sort of thing many economists were gloomily writing for much of 2022. What has surprised markets and investors is just how resilient the global economy has been since then.

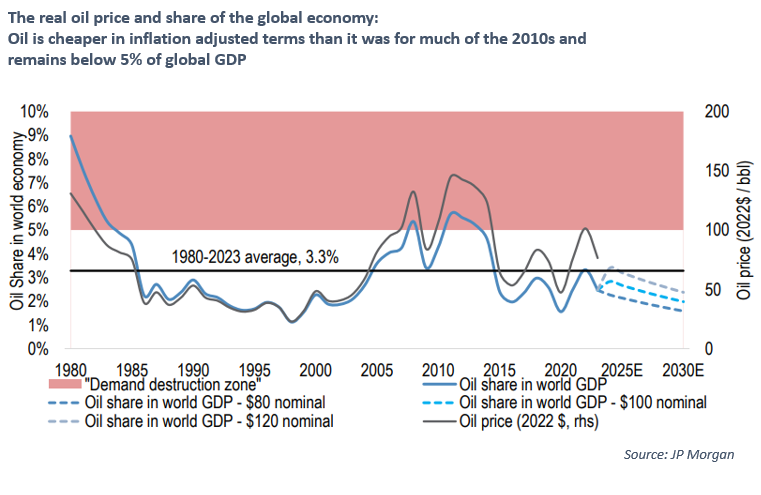

Will this resilience continue? One plus is that there is probably more good news around today than there was 12 months ago. Inflation is finally falling meaning that people’s income after inflation should start to rise for the rest of the year. Also, oil at $90 is high relative to 3 years ago, but still below much of where it sat in the 2010s in inflation adjusted terms and it is below 5% of global GDP (the rough level which has triggered energy shocks in the past).

Indeed, one of the main reasons that longer-term interest rates are rising is that investors no longer think a recession is on its way. If the economy can live with 5% interest rates, then it makes sense for longer term interest rates to drift up to 5% as well. We still think economies will eventually succumb to the pressures higher interest rates put on them. But we try and balance this with enough equity exposure to make sure that if today’s economic resilience continues we are not caught too short. Overall, I think we have the right mix on today but, as ever, it is the future that matters. I’ll be writing our usual quarterly overview next week and will review our 12-month outlook then. Hopefully, most of you will receive this in due course, but if you would like a copy please get in touch.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.