Asking economists for investment advice is like asking a physicist to fix a broken toilet. Not their field, though sort of related – Milton Friedman

I wrote a couple of weeks ago that bearish stories in the Times (Bond markets are warning us the party’s over) and the BBC (Bonds: The flashing warning sign that is worrying investors) might in fact be a decent contra indicator that the worst was over the for bond market sell off. Well, my news this week is that The Times and BBC may well have pulled it off. On Tuesday and Wednesday, we saw inflation numbers in the US and UK come in under market (and central bank) expectations. Bond markets rallied hard and are now expecting no more rate rises this year and interest rate cuts in 2024. This then triggered a relief rally in the sectors most under pressure from rising interest rates including small and mid-cap equities, real estate investment trusts and the investment trust market more generally. After a tough start to the quarter, most markets we track are back in green.

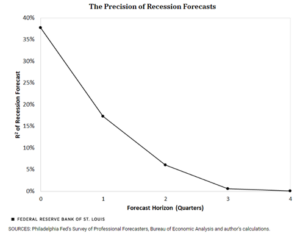

If that is the short term (this month), what about next year? Here investment people often start with their economists’ forecasts for the year ahead. But how much weight should we put on these forecasts? 12 months ago, most economists were convinced the US would see a recession this year (and were even more certain about this for the UK and Europe). I am pleased to say they were wrong. And they were particularly wrong about the much-studied US economy which saw 5% annualised growth in the third quarter alone. This got me thinking, how much weight should we attach to economists’ forecasts anyway? Luckily, the Federal Reserve Bank of St Louis have attempted to answer this question by looking at the track record of professional US economic forecasters. The results are below:

What can we take from this? For me, shorter term forecasts are worth listening to (i.e. how we are doing right now and at the start of next year). Longer term ones run into the problem that the global economy is a huge, adaptive system with billions of individual agents constantly adapting and evolving to changing circumstances. If long term weather forecasts are right, it is normally only by chance. The same is probably true for the economy. This is relevant, as I often come across forecasts along the lines of: the economy should be OK in the first half of the year but watch out for the second half (or vice versa). The St Louis Fed data would say only the first half of these forecasts are worth listening to. Today, I don’t see many forecasters calling for recession now or in the next few months and equity markets (also a good leading economic indicator) remain solid. This may be as positive as you can ever be about the outlook for next year.

The other way to look at what investors expect is to look at how they are positioned today. What people do is often a better indicator of what they think than what they say. To that end, here is the latest investor survey data from Bank of America:

This paints a more bearish picture for me. The active investment community as a whole is overweight bonds and underweight equities. This says they expect some sort of recession in 2024 (an environment where bonds would normally out-perform equites). They may well be right here, but if the growth and inflation data continue to be solid (as it has been for the last few months in the UK and US at least), then the investment community might be underweight equities as a whole in a rising market.

Part of the rally this week was investors who were short bonds and/or underweight smaller equities rushing to buy back their positions and get closer to neutral. If the data stays strong, we may see more of this buying in the next few months. I wouldn’t put it past the global economy to wait until most investors were back to being positioned long again, before it finally decided to have its recession.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.