My weekly note started as three (sometimes unconnected) investment related data points that I thought were interesting enough to pass on. As time has passed I’ve spent more time talking about inflation, interest rates, house prices and other issues that were probably closer to investors’ and our clients’ hearts. However, in the spirit of my original notes, here are three unrelated things that caught my eye over the holiday break. For those looking for more depth, I also wrote our fourth quarter client review note this week. This has our review of last year and the outlook for 2024. If you’d like a copy please do get in touch.

First though (and thanks to Joachim Klement at Liberum for this), the start of the year is a time for making forecasts for the year ahead. There are really two sorts of forecasts: one is top down and focusses more on things like the economy, valuations and investor sentiment. The other is more bottom up and looks at each company and how much money it should make in the year ahead. Top down and bottom up forecasts are related of course but they tend to come from different sorts of people. Top down forecasters are often asset allocators (such as me) and market strategists. Bottom up forecasts tend to be the aggregation single stock analyst predictions. Joachim ran the numbers for the US S&P 500 market and they are below. I am afraid to say neither forecast would have helped you much.

What was interesting to me was that top down forecasters (and I’d include a lot of asset allocators here to be honest) are on the whole too pessimistic. They forecast 4.3% per annum on average, well below the actual return for the S&P 500 of 9.8%. Bottom up forecasters in contrast were too optimistic, forecasting 11.6% p.a. Equity markets have returned 7% to 8% on average over the last 100 or so years. A simple 7.5% estimate would have beaten both the top down and bottom up experts. So there you have it, my forecast for this year’s equity returns is 7.5%.

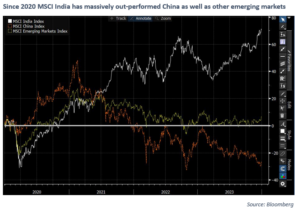

The pointlessness of 1-year equity market forecasts is one of those things that you know well but is always worth reminding yourself of. Another thing like that for me is the continuing rise of India. It is startling just how much India has eclipsed China in recent years. Since the start of 2020, the MSCI India equity has returned over 70% in sterling terms to investors. This compares to a gain of just 6% for emerging markets overall and a loss of -27% for MSCI China.

The contrast between Chinese GDP growth (which has held up pretty well) and its equity market performance (which has been dismal) remains remarkable to me. Positioning for a rally in China is for the brave but you will have some very attractive valuations on your side.

Finally, it was New Year’s Eve a few days ago. I was struck by images of the thousands of people who attended the fireworks all having their cameras out in unison to film the event. This is a very modern phenomenon and it made me think of the cartoon below. A happy new year to you all and I hope the positive market momentum we saw at the end of 2023 can continue into 2024.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.