The generally good economic data flow continued this week. For whatever reason, I have the early Blair years (so the late 90s) as being a pretty decent economic era to have been around in for us Brits. I think Americans generally feel that way about the economy in the Clinton years (again, basically the 90s). Well, that’s pretty much where we are today. In fact, you could make the case that us Brits are in better shape now than we were in the late 1990s. UK unemployment is 4.3% today vs 6.5% when Tony Blair took power. Even interest rates – which feel eye-wateringly high today at 5.25% – are below the 7.25% they peaked at in early 1998.

Of course, it does not feel like that. I don’t really want to speculate why, though it is striking to me that in the US most Republicans think the economy is doing badly (and getting worse), whereas most Democrats are more optimistic. This is, of course, politics and the impact of today’s more partisan media environment. Republicans think the economy is trouble because there is a democratic president (I would guess their views would switch pretty quickly if Trump is re-elected this year). The breakdown of traditional national media means that each political group now gets much more of its news from their sources on their own team. You would have a very different view of the UK if you only read the Guardian vs only reading the Telegraph.

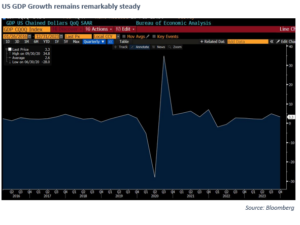

But whatever the sentiment of the voters, these are (with the notable exception of China) good times for the global economy. The first estimate of Q4 US GDP came out on Wednesday at 3.3% annualised. This means US growth was 2.5% above inflation in 2023. That is pretty remarkable given the interest shock that hit many parts of the economy. Meanwhile, the Feds preferred measure of inflation – US core PCE – came in at exactly 2% for the second quarter in a row. I am not sure it is possible for two key pieces of key economic data to come in better than that in a week.

But data like GDP and Inflation is of course backward looking. The other piece of good news this week is that forward looking survey data (which has been gloomier) are also starting to pick up. And, happily, we also see this improvement happening in the UK. UK composite PMIs are solidly back above the 50 level which indicates expansion.

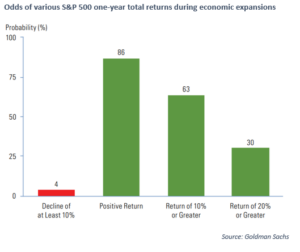

Rather like Republicans in the US, it is easy to be more pessimistic about the outlook than the actual data would justify. And it is always worth remembering that, assuming this forward momentum can hold up, years of economic expansion (like 2023 and 2024 so far) are also eras of solid investment returns.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.