UK interest rates hit 5% last week and are now expected to rise to over 6% by the end of the year. One fair question we receive is why don’t we just put some of our clients’ funds on deposit and earn this 5% rate? After all, 5% or so risk free is (by recent standards at least) an attractive return. It is also tempting to sit in cash and wait and see if the long-anticipated UK recession does eventually turn up.

Well, we aren’t doing this today. Here are three reasons why:

- First, although the yield on cash is attractive, we think we can earn more without taking on too much extra risk. High quality, short dated corporate credit offers around a 7% yield today. We think the extra return on offer more than compensates you for the added credit risk and slightly longer maturity of the bonds (around 2-3 years on average).

- Secondly, though cash is (more or less) risk free it might not be the best asset to protect you if the global economy does indeed start to slow. Longer term UK government bonds can lock you into a 4.4% yield today. The advantage this has is that there are potentially capital gains on offer if the UK slips into recession. As an example, when Covid hit many parts of the global economy ground to a halt. Our core UK government bond fund made over 10% in a few short months in early 2020. We think similar capital gains might be on offer if and when the impact of higher interest rates finally hits home to UK consumers and companies.

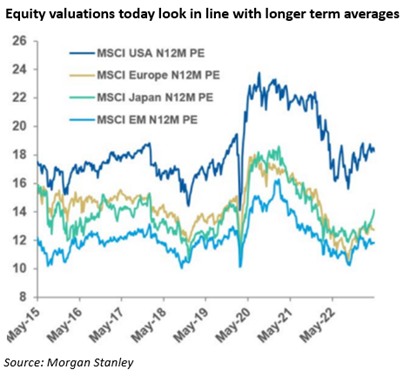

- Finally, this year has shown that equity markets can always – in the market jargon – keep climbing the wall of worry. It can be tempting to sit in cash, wait for things to settle down, and then reinvest. The problem with this approach is that you can miss the large early gains that happen in any market rally. Also, it is worth noting that equity valuations (especially outside the US) look pretty attractive today and there is no reason to think you won’t be able to make typical equity style returns (say 7%-10% per annum) over the medium term from today’s starting point. A core equity allocation – appropriate to your own personal risk level – does not look unattractive to us, even compared to today’s cash rates.

This means we think it makes sense to keep the core allocation to global equities that is consistent with your risk level. Outside of equities, cash rates today are tempting but we think we can get a better yield on corporate credit and more downside protection from government bonds. This is not to say we would never use cash or cash alternatives in our portfolios, it is just today there are some better options available.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.