I have written here before about how front covers from The Economist magazine can often mark the end for a particular trend. One famous example is The end of the oil age cover in 2003 which marked the start of one of the most explosive run ups in the oil price in history. I was reminded of this this week when I was sent two newspaper articles by clients. One from The Times (Bond markets are warning us the party’s over) and the other a BBC news story (Bonds: The flashing warning sign that is worrying investors).

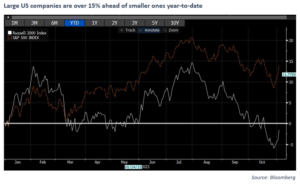

Well, this is the week bond markets decided to rally. For asset markets – and returns for the rest of the year – I hope this proves to be the end of a trend rather than a bear market rally. Higher bond yields mean higher borrowing costs for businesses and mortgage borrowers. This particularly affects smaller companies which (i) are more reliant on borrowing costs to grow and (ii) pay more anyway as they are smaller companies are generally riskier propositions to back. To illustrate this, US small and mid- size companies are down -1.5% year-to-date. The large cap S&P 500 Index is up +14%. Smaller caps have been hit harder by the impact of rising borrowing costs.

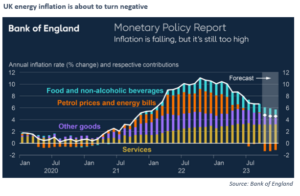

The reasons for this rally in bonds (apart from getting the all-clear from The Times and the BBC) were less than expected borrowing by the US government and the latest central bank meetings in the US and UK. The US signalled for the first time that – absent a reacceleration in inflation – the peak is for US base rates is in at 5.5%. In the UK, the decision was closer (6-3) for no rate rise but it is clear that central banks are starting to look forward to a slowing economy rather than reacting to last years’ cost increases which still show up in the annualised inflation data. The worst looks to be over for UK energy cost pressures for example. As you can see below, energy price inflation is forecast to turn negative in the next few months.

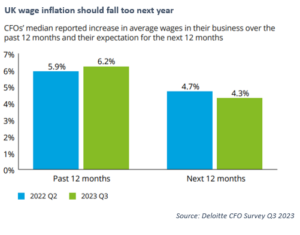

There is also hope that UK wage inflation will start to turn down as well. Below is data from a quarterly survey of UK CFOs run by Deloitte. Forward looking wage increases are expected to be 4.3% (and falling) compared to over 6% for the last 12 months.

Higher interest rates impose huge financial burdens on a small number of people (including mortgage borrowers and small business owners) whilst benefitting older people who own their home outright and larger businesses who often sit on large cash balances. There is something very unjust about the way the interest rate brake works on the economy. We were glad to see the brake being eased a little bit this week. If this really is the end (or near the end) of the worst of it then our fixed income and more defensive alternative investments should be able to continue this week’s rally. I hope The Times and the BBC are wrong.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.