Japanese equities are up 25% so far this year. This makes them the second-best market we track (coming after the US Nasdaq market which had a horrible 2022). A client has asked whether we think they look like an opportunity for the next 12 months. The argument usually put forward by Japan bulls would be (i) Japanese equities are cheap and (ii) there is a catalyst on the way (often prompted by the government) to make Japanese businesses more shareholder friendly and so unlock some value for investors. Are we seeing this catalyst drive out-performance for Japan for the first time in a long while?

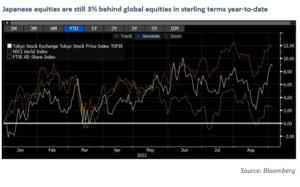

To jump straight to the conclusion: we don’t think so. Firstly, a weaker Yen has been behind much of the Japanese market’s out-performance. A weaker yen raises the value of overseas earnings in yen terms and so pushes up Japanese equity prices. However, for international investors such as ourselves, although the headline index return is higher, the currency it is measured in is worth less. Putting this together, Japanese equities are really up only 9% in sterling terms. This is 6% ahead of the UK All-Share market but 3% behind global MSCI World index. The weakness of the Yen is not hard to explain: interest rates remain at 0% in Japan compared to the more than 5% available in the US and UK. To keep Japan looking an attractive place to invest, the Yen needs to weaken to make Japanese investments cheaper for foreigners. We don’t see much in the short term that will mean this interest rate differential will change much.

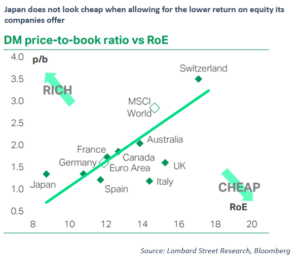

If they are not out-performing currency adjusted, are they in fact cheap? A headline price/earnings ratio for Japan of 15x is below the United States (which trades at 20x) but is well above the bargain basement UK (trading at just 10x). Equity investors are also always prepared to pay more for better companies. One way of measuring this is by looking at return on equity. Unfortunately for Japan, it has historically had the lowest return on equity of all the major developed markets (as shown below).

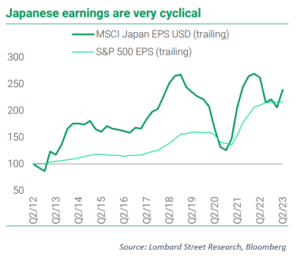

The other knock on the potential Japan opportunity is more tactical. Japanese companies are typically cyclical and their profits are more geared to the ups and downs of the global business cycle as we show in the chart below. We think we are starting to see the signs of higher interest rates in the developed world finally feeding through to slow economic growth. How serious this slowdown is remains to be seen but buying a cyclical ahead of a potential recession is for investors who are braver than us today.

If those are the negatives, what is there to like? First, Japan’s traditional expertise in technology is real and Japanese technology companies have been able to match the strong returns of the US Nasdaq market so far year to date. Second, the inflationary wave that has washed through the world post-Covid is on balance a positive for Japan which has been struggling with a deflation since the spectacular collapse of its property bubble at the end of the 1980s. Wages, in particular, look to be picking up which should be a boon for domestic spending growth.

Finally, the potential for corporate governance reform and improved profitability for Japan’s companies is still tantalisingly there. Growing share buybacks have supported returns recently and there is potential for Japan’s corporates to do more. That said, hope is not an investment strategy. In our portfolios we prefer the more concrete growth on offer in US markets balanced by the out and out cheapness of the UK. Japan remains on our radar but is not top of our list of opportunities today.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.