Plenty has already been written about the new war in the Middle East between Hamas and Israel. I do not mean to add much to the geo-political commentary here. The human suffering and loss of life that this war (and Ukraine) has generated and will continue to generate is of course appalling. We wish for as peaceful as possible resolution to both conflicts. That said, I do feel qualified to update you on the impact the Hamas attack has had on investment markets and where we see the risks from here.

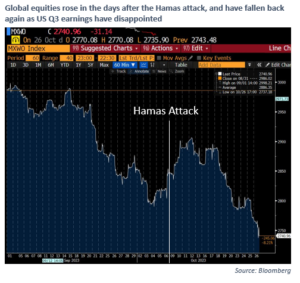

The uncomfortable truth is that – from an investment and financial point of view – Israel and Palestine are just not that important for most markets. Israeli GDP is around 0.5% of global GDP (compared to 16% for China for example) and it is not directly involved in any oil production. To illustrate this point, here are global equities (measured by the MSCI World Index in US dollars) before and after the Hamas attack.

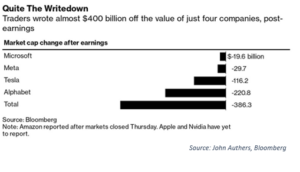

It is earnings season in the US and global equities (over half of which are based in the US) have been reacting to this. Initial positive earnings surprises have been followed by disappointments from some of the technology mega-caps (including Google and Tesla). The high valuations for these superstar companies make them vulnerable to any disappointment and equities have fallen recently as a result as you can see here:

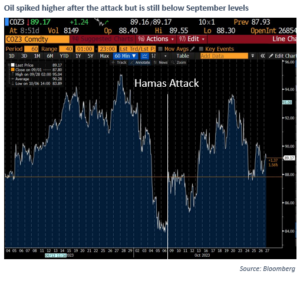

Nowhere in the MSCI World equity chart can you see the impact of the tragedy in the Middle East. That said, there are a few markets where the impact has shown up. Gold, the ultimate safe haven asset is up 8% since the 6th October. The Swiss franc – a classic safe haven currency – has also bounced though we have seen no reaction from the Yen. Oil markets have also understandably pushed higher after the attack, though they still remain below their September levels.

Our best estimate is that Israel’s retaliation against Hamas will keep this war front and centre in the news. However, if the war remains contained then investment markets’ focus should continue to be elsewhere (and mainly on the global economy, interest rates and earnings). The risk is that Iran chooses to escalate and enter the war directly rather than via their proxy Hamas. This could threaten oil deliveries from the Strait of Hormuz and could trigger a new inflationary commodity price shock just as inflation was starting to come under control again. This would of course be good for Russia (an oil exporter) but bad for China (an oil importer). Our best guess is China’s interests will trump Russia’s here. Russia also has enough problems in Ukraine without getting directly involved in another regional conflict.

This means our focus as investors will continue to be on the economy, interest rates and earnings. We continue to think a slowdown is on its way which should mean our more defensive fixed income and alternative positions will start to deliver. Apart from that, from a humanitarian perspective we continue to hope the human toll remains as limited as it can be and our thoughts and prayers remain with all those directly and indirectly affected.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.