I wrote our quarterly investment review last week. This is our more detailed review of the first half of the year and our outlook for the rest of it. The link is here for those that want a deeper dive into our positioning and where we think we are in the cycle. I was therefore going to use this opportunity to write about a few bigger picture, thematic things that are not so markets and week to week. But this was a big week for inflation data so instead, sigh, here is your weekly inflation update.

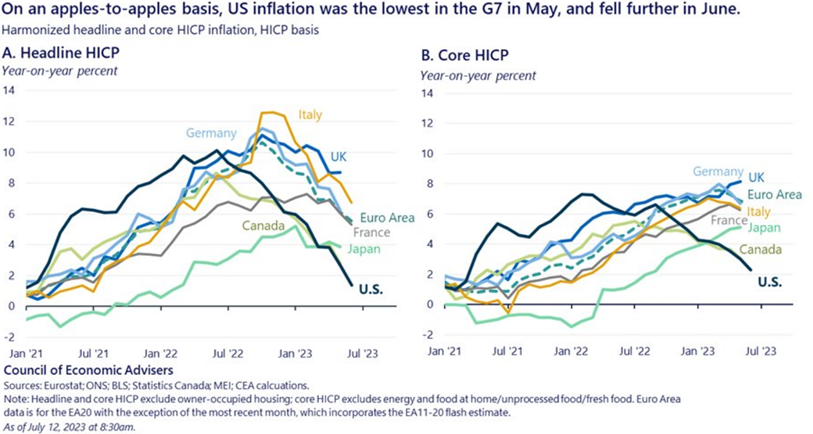

I often hear that the old world is lagging behind the new world. I just hope this is the case when it comes to inflation. The June inflation report came out of the US and it continued to show – for the US at least – that inflation is last year’s story. The contrast with Europe (and particularly the UK) is stark as you can see in the graphs below.

These charts are produced by Biden’s in-house economic team and adjust for differences in inflation calculations between countries. It is the core chart that is particularly striking. Core inflation on this measure is 8% and rising in the UK vs 2% or so and falling in the US. You can see in the charts that the US led on the way up. I continue to believe it is leading on the way down too. Hope, however, is not reality. Until we see some evidence of slowing UK inflation, interest rates here will continue to rise.

On this, earnings data came out of the UK this week. As with all things UK inflation, this remains strong. You might think wage inflation is concentrated in areas like hotels, restaurants and retail which are struggling to hire post Brexit. But you’d be wrong. It is in fact finance and business services (more expensive employees) where wage growth is the strongest. Hotels and restaurants are in fact the weakest sector at the moment.

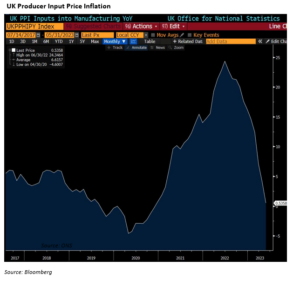

On risk to the more optimistic view is that the economy remains strong in the US and Europe. What chance is there that this strength generates a second wave of inflation (as we saw in the 1970s for example)? So far, we don’t see much evidence of this. Commodity prices remain well below last year’s peaks and inflation rates seen by producers (which feed through into actual inflation experienced by consumers) is still pointing down. As an example, here is producer input inflation (PPI) for the UK which is almost back at zero. We hope (and expect) broader UK inflation will ultimately follow PPI inflation down.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.