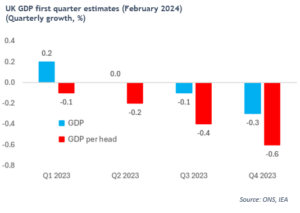

If you awoke from a coma and someone told you that the UK economy was in recession and inflation was negative, I’d hope that you’d reach over from your hospital bed, take a sip of water, and croak to the doctors “cut interest rates”. Well, this week we got provisional UK GDP data which showed that the UK is indeed in a technical recession (i.e. two consecutive quarters of negative GDP growth). And remember immigration levels have been running high. Just adding workers mathematically increases GDP. Once you adjust for this GDP per capita (so output per worker) was falling for all of 2023.

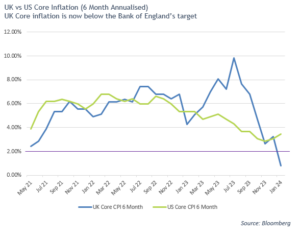

But what about inflation? Last year UK exceptionalism meant inflation rates running at much higher rates than other developed economies. Well, this has corrected and now our inflation rates are lower than other comparable countries. UK core inflation is running at -2.4% over the last 3 months annualised and at +0.8% over the last 6 months, below that Bank of England’s 2% target. 12-month core is still above the bank’s 2% target but I am not sure why what happened in the first half of 2023 really matters. Isn’t the last 6 months’ experience the more relevant for 2024?

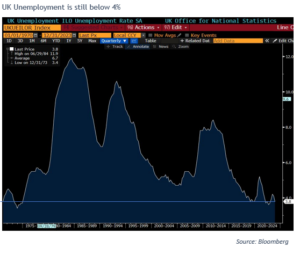

So why does the market not expect the Bank of England to cut rates in March? The answer is unemployment remains remarkably low. If everyone has a job what would interest rate cuts actually achieve? And it looks like pretty much everyone who wants a job has one. UK unemployment is currently at 3.8%. This is lower than at any period in the 4 decades from 1980 to 2020.

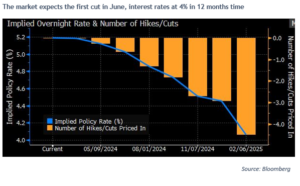

Low unemployment combined with falling GDP implies that workers are keeping their jobs but doing less while at work. At some point you would expect companies to notice this and start laying off employees to become more efficient again but, because it is expensive to hire and fire people, unemployment is one of the slowest moving indicators of economic activity. If and when it starts to tick up then I think that interest rates will fall faster and further than the market thinks (current market expectations are in the final chart below). I continue to like UK fixed income here.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.