For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

The first £1m football transfer (Trevor Francis to Nottingham Forest) was 44 years ago this week. Duncan Alexander of the Athletic has calculated that if the same inflation that has happened to football transfers happened to other things we buy then a pint of beer would cost £50 today and a colour TV would cost £28,000. Whilst, for those of us living in London at least, a £50 beer is not completely unthinkable, a £28,000 TV is. This highlights the incredible improvement in quality and fall in prices we have enjoyed in many goods markets over the last 30 years. The Covid shut-down saw this deflationary trend end. However, in the second half of last year we saw some return to normalcy and prices for many goods started to fall again. How likely is this to continue?

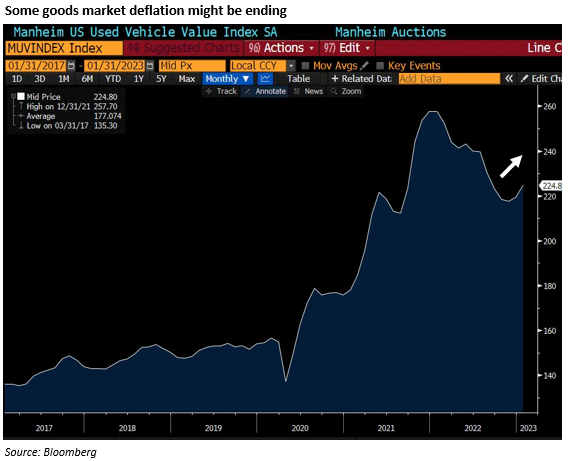

I write this because some very strong jobs numbers came out of the US on Friday last week. As an investor this is the sort of thing you would normally want to see. Vanda Research (one of our research providers) have calculated that if jobs markets are really this strong, it has taken at least 2 years from there to reach a recession. There are normally some very good gains to be made in equity markets in the two years before a recession. At some point, however, continued economic strength means inflation risks come back on the agenda. Indeed, we are starting to see some signs of an inflationary pick up on the goods side of markets (after a few months of price falls). Used car prices (measured by the Mannheim Used Car Index) are up 3% from their lows and we hear anecdotally of more strength to come in this market.

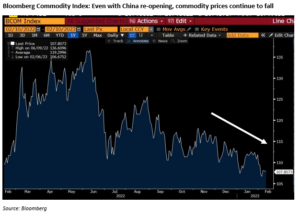

That said, we continue to think that a growth slowdown remains the bigger risk. My three things this week are three reasons why we lean this way. First, there is the mystery of oil prices. If growth is strong and China is re-opening (as it clearly is) then why are oil prices falling? And it’s not just oil, below is the broader Bloomberg Commodity Index which is in a clear downtrend. And remember this is measured in USD dollars. Recent strength in the Euro and Sterling means this has actually been falling faster for many of us in Europe.

Second, as we wrote last week, the bond market is telling you that too strong growth is not the problem it fears. The reason for this is – in the jargon used in bond markets – that the yield curve is inverted. Short term rates (including today’s bank base rate) are above longer term interest rates. In the UK the bank base rate is 4% today and the 10 year gilt yield is 3.3%. Though the bond market is not perfect (and it was very wrong at the start of 2022) it has a much better track record than any forecaster of predicting growth slowdowns and recessions. The UK bond market is pricing in its first interest rate cut in November this year. Like commodity markets, it does not seem to be too concerned about the economy running too hot.

Finally, housing markets remain understandably weak given the recent increases in interest rates. This is equally true in the US and UK. For the latter, some Royal Institute of Chartered Surveyor data came out this week showing new sales instructions outstripping new buyers at levels we last saw in 2011 and the 2008 financial crisis. Housing is typically one of the most cyclical parts of the economy. When housing bottoms you can be more confident that any slowdown is over. We look to be a way away from that today.

This means we continue to like bond markets as a source of yield and some protection if and when the slowdown happens. The risk to this, of course, remains a pick up in inflation. We do not see this in housing or commodities today but, as the saying goes, if the facts change we remain ready to change our opinions.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.