For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

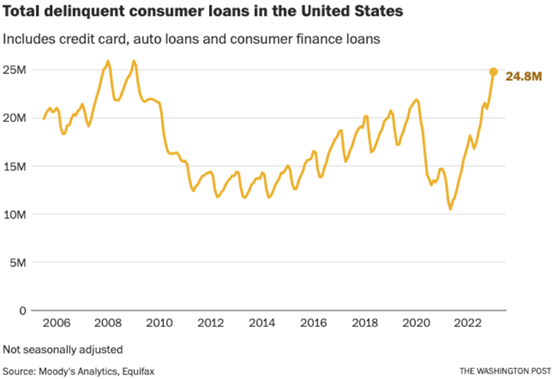

Probably my favourite cartoon as a kid was Roadrunner. The star of the show was Wile E Coyote, a wolf with complete and total faith in the products of the Acme corporation. Every now and then, Wile E would find himself running off the edge of a cliff and be able to keep going for a few seconds before pausing, seeing where he really was, and falling into the valley below. One risk we face today as investors is that the US and UK consumer is already over the edge of the cliff and just does not realise it. Consumer spending numbers and survey data suggest there is no problem, but if you look under the hood then you can start to see where some of the problems might be. For the UK, it must only be a matter of time before the reality of higher mortgage and energy payments starts to hit. In the US consumer spending has started the year very strongly, but a lot of this looks to have been paid with borrowed money. As you can see below, delinquencies on consumer loans (by number at least) are back close to their 2008 highs.

We continue to think this pushes the balance of risks towards a slowdown rather than a reacceleration in the global economy. Relatively safe investment grade corporate bonds yielding over 5% look like a good place to earn a return if we are right.

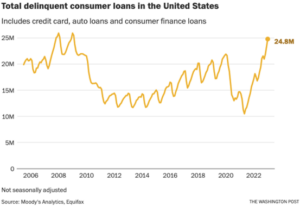

Another reason to favour caution over bravery here is the sheer speed and size of the interest rate rises we have seen. It is likely that many consumers and companies have not fully adjusted to the new reality. Interest rates in the Eurozone are expected to reach 3.75% in the summer of this year having been minus 0.5% just 15 months ago. Similarly the rate raises we have see in the US have been unprecedented in recent times:

A sustained re-acceleration of the economy given this backdrop would be pretty miraculous. Our view remains that slowdown is on its way.

Let me finish with something a bit more optimistic. I wrote a couple of weeks ago about AI generated stories swamping the Clarkesworld sci-fi magazine application process. (Clarkesworld is a well-run magazine that will pay you 12 cents a word for anything it publishes in case you are interested). More generally there is a worry that AI powered software will slowly take away the jobs of lawyers, doctors and even, gulp, investment professionals. Maybe what you are reading is already written by a sentient AI just biding its time before it takes over the world?

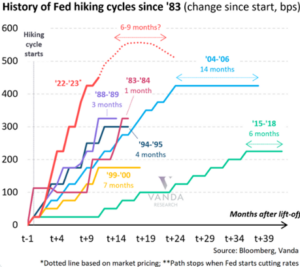

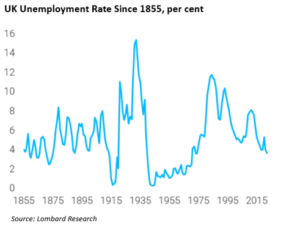

I (or is it the AI?) would play down these fears. The future looks likely to be people working with AI driven software to become more efficient. And remember it is efficiency gains (making more with less) that ultimately makes us all richer. There is a good chance that the future we are hurtling towards is a better one. One piece of evidence for this is the long run (since 1855) unemployment rate for the UK. This is a time that has seen steam engines, trains, electricity, cars and more recently computers and the internet revolutionise how we get things done. The large unemployment spikes you see below are entirely man made either through wars or (in the 1930s and 1970s) economic mismanagement.

As Kent Brockman would say on the Simpsons, if AI is indeed going to change everything again, let me be the first to welcome our new masters.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.