For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

My last weekly note was at the end of December. The consensus view then was that a slowdown was on its way and there would only be slow progress on inflation. Interest rates would stay high, equity markets would be under pressure. This is pretty gloomy but it is worth remembering the consensus outlook at the end of 2021, that inflation would stay under control. This proved to be hopelessly wrong. Since the start of the year we have had plenty of data on inflation and the economy. It has, on balance, been pretty good. Though we are less than 10 business days in, equity markets have got off to strong start.

It is of course still possible that this is a brief respite and the consensus is right to be pessimistic. Another “risk” is, however, that 2023 is not as bad as many people expect. From an investment perspective this of course means not owning enough in risky assets to capture the recovery rally. One reason we have not been as defensively positioned as we could have been is that this remains a real possibility for 2023. The recent data has, on balance, supported this positioning.

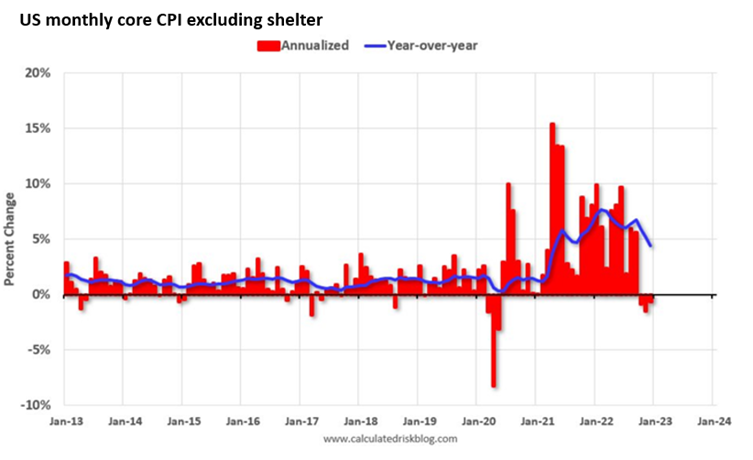

As an example, monthly inflation data for the US came out yesterday. Headline CPI inflation continues to fall and is now – on an annualised 6 month basis – below the Federal Reserve’s 2% target. Inflation swaps also forecasting annual US CPI to be at (exactly!) 2% in July. Finally, and more importantly for the Fed, core inflation excluding shelter has actually been negative for last three months as you can see in the chart below. It is informative to exclude shelter (which broadly captures housing costs) because lags in its calculation mean that it is still pointing to the housing boom that happened in the first half of 2022. More up to date measures show house price and rent inflation is falling in the US. It is looking like the US Fed might have done enough to bring inflation down.

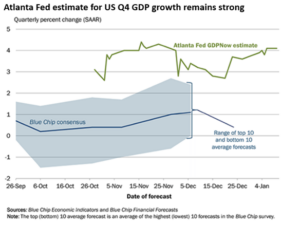

If inflation is slowing, is this coming at the cost of a slowing economy? The short answers is that parts of the US economy are starting to feel real pain. Real estate (most sensitive to rising rates) is slowing sharply. Technology companies, many of which benefitted most from the flood of money looking for a home in the zero interest rate era, are also retrenching. However, this slowdown looks nothing like a full blown recession (yet). The Altanta Fed puts together an estimate of current GDP growth using the latest data releases. This is currently tracking at over 4% (annualised) for Q4 2022. Unemployment rates are also close to all-time lows. If the US does enter a recession, it will be from a very strong position today.

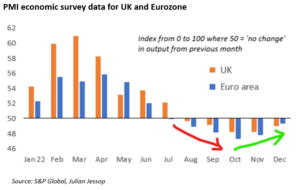

Finally, it is worth mentioning that the UK and European economies have also held up better than expected, in part because a milder than usual start to the winter has meant less of a hit from energy prices. Survey data has also been picking up. Goldman Sachs released a note this week saying they no longer expect a European recession in 2023. As the energy price shock has been far larger for Europe, the overall inflation and growth mix is much weaker. Still, the broader economy is holding up better than people thought a few months ago.

Falling inflation with economic growth holding up is a good backdrop for investors. The rally we saw in Q4 has continued into the early part of this year. It is still, however, far too early to declare any kind of victory. First, interest rate rises operate with lags so the strength we see in Q4 may evaporate as higher rates finally start to affect consumer spending and corporate investment. Forward looking survey data for the US has been worsening recently suggesting that this might be starting to happen.

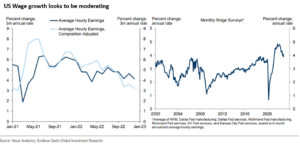

Second, the flipside of the economy remaining strong is that labour markets also remain very firm. This is in turn means that wage inflation remains above levels consistent with a 2% inflation target. There has been some encouraging recent news on this too (including falling earnings data in the January jobs report), but until this trend is confirmed the war on inflation (and hence the pressure on asset markets from higher interest rates) is not over.

We will, of course, continue to monitor this backdrop and adjust our positioning if it changes. We’d also like to wish you all a happy and prosperous 2023. For the two weeks of the year at least, the economic data is giving some extra support to those wishes.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.