For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

This week I attempt to answer the timeless question: are older people better than younger people? Believe it or not, it was looking at the opportunity in European equities that got me thinking about this. I’ll do my best to explain why below, but this started with some good news on European energy production that came across my desk this week.

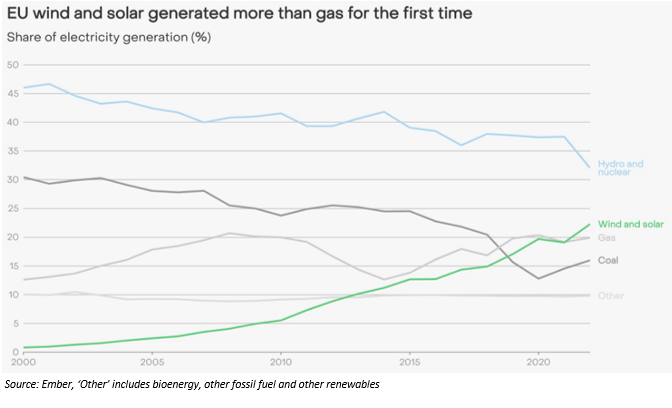

Wind and solar energy is now generating more energy than gas in the European Union for the first time ever (as you can see in the chart below). It’s a similar story in the UK where around 45% of energy now comes from solar, wind, biomass and hydropower. When you add in the 15% that nuclear energy generates we are actually doing a bit better than the Europeans with 60% coming from non-fossil fuel sources today. This is an incredible improvement from 20 years ago when renewable power generation was close to zero. We continue to like and hold our investments in renewable energy providers.

This improvement in renewable energy production is, as I have written before, one reason why Europe has been able to withstand the cutting off of Russian gas supplies much better than many expected 6 months ago and has been a driver of the recent bounce we have seen in European equity markets. How much is this a contra-trend rally and how much the start of something new? First, the underperformance of Europe (and I am including the UK here) when compared to the US really is something to behold. Here is the underperformance of Europe relative to the US since 2007:

The main point to understand from this chart is that this under-performance has not been irrational. US companies have simply made more money (on average) than European ones over the last 15 years. As earnings rise, so do equity prices. A second effect is that investors (rationally) start to pay higher prices for this better growth. Prices paid for lower growth European stocks fall and a valuation gap opens up. You can see this gap in the (equal sector weighted) relative valuation of US and European equities today.

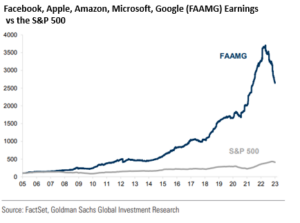

Whenever you see a long trend like this, the question is what might make it reverse? One thing I would point to is that much of the US out-performance of the last 15 years has come from a handful of US technology giants. The chart below shows the earnings of Facebook, Amazon, Apple, Microsoft and Google (FAAMG) relative to the rest of the US market. Interestingly, in the last 12 months these earnings finally look to have reached their limit. As they have fallen so European earnings have done relatively better and European equities have started to recover some of their lost ground. With valuations where they are this recovery looks like it might have some legs and we added to our European equity positions earlier in the year.

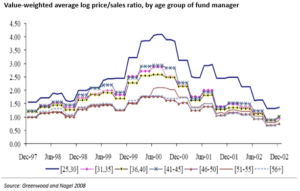

One part of the job of being an investor is understanding – where and when you can – the biases you have and doing your best to allow and adjust for them. You’ll notice from the above that I am pushing for cheaper, low valuation markets over more expensive ones. Might this be because I am just – well – old? Research below shows the weighted average price to sales of equity manager portfolios split by the age of the equity manager (I am in the 51-55 bucket by the way) in the dot com boom and bust from 1997-2002. Simply put, older investors owned cheaper companies. Post the dot com bubble in the early 2000s this was right thing to do! I just hope our judgement is proved right in Europe today.

But before I start crowing over the next generation, it is worth remembering that at times (like the last 10 years for example) it can be worth paying up for growth. Younger people (less burdened by the past) can often see future trends more clearly. The larger trend of technology driving earnings growth looks like it is here to stay. We will not be selling the (technology heavy) US equity market just yet.

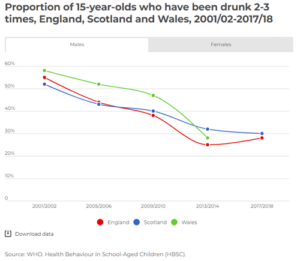

Finally, it is always striking to me how much better behaved the current young generation are compared to my (and previous) ones. Drug, alcohol use and teenage pregnancy rates are all falling. My guess is today younger investors are still more likely to own higher growth, more expensive companies. But it looks to me likely that they will – on average – have fewer hangovers to deal with when they do so.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.