For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

This week:

- Bad news is back to being bad news as we see increasing signs of a slowdown in Europe and the US …

- … but this is not the case in China

- and we finish with the latest data on UK house prices, which makes, we think, for some interesting reading.

Last week I wrote that the peak for inflation looked to be in for the US. This and the fact that growth is holding up better than most had predicted has meant some recovery from last year’s lows. The worry that the market had was that the economy was running too hot and interest rates would have to keep rising and rising to cool it down. Wherever you look (and we show current activity data below) we are seeing a slow-down. The interest rate rises we have seen so far have done their job. If the economy is too hot then bad news is good news: you need to see a slowdown to bring inflation back to more normal levels.

At some point, the economy becomes “just right” (this is where the ever popular Goldilocks analogy for the economy comes in). I think we are there for the US. For the UK and Europe we’d need to see inflation come off a bit more from today’s levels but I think we are not far from that happening. When the economy is “just right” some normalcy returns and bad news becomes, well, bad news once again. US Retail sales came in (strongly) negative for a second month in a row this week. Survey data is also pointing down. Again, part of this could be the whipsaw effect of Covid re-opening washing through inventories. But rising interest rates and energy prices should ultimately dampen demand. We are finally seeing the effects of this come through in the data.

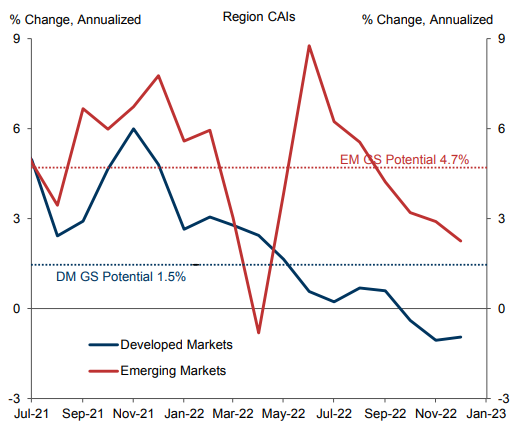

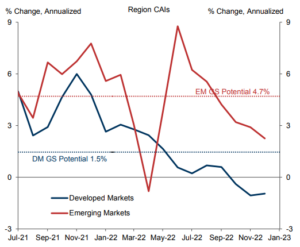

You can see the impact of falling demand in forward looking measures of economic activity like the Goldman Sachs’ Current Activity Indicator for developed markets which is below. Falling inflation and slowing growth is normally a good environment for bonds (which had a terrible 2022). We are already overweight bonds but have been getting more defensive with our bond positioning this week. The traditional effect of bond portfolio gains offsetting equity losses did not work at all last year. But we think bonds look more likely to play their more traditional role of being a safer equity alternative this year.

Current Activity Indicators are pointing down once again

![]()

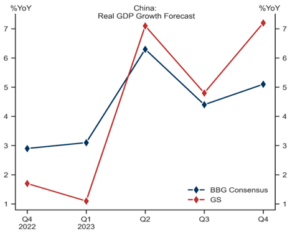

The good news we have this week comes from China. Here the economic cycle is in a very different place. The exit from zero-covid is happening faster and (so far) more smoothly than most people thought possible a few months ago. If the covid exit boom is ending in developed markets, it is only just beginning in China. This makes the whole Asia ex-Japan region (and emerging markets in general) look attractive. China’s covid journey will be different to ours (there were far fewer subsidy and furlough payments for example) but their economy is in a very different place. We should get some (hopefully positive) diversification benefits from our Asian centred investments.

China re-opening should boost growth in the region

![]()

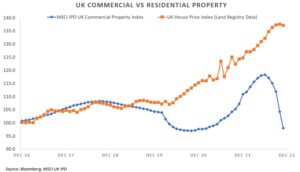

Finally, closer to home, one of the interesting features of the last few months has been the performance of the UK commercial property market. In the 2008 crisis valuers were (we thought) slow to adjust to the reality of lower values for offices, retail and industrial units. We have not seen this slowness this time round. Looking at the UK IPD market index (which is driven by surveyor values) commercial property prices are now almost 20% below where they were 6 months ago. Given the rise in interest rates, this feels about right. As the yields on safe assets have risen, so the yields on riskier, illiquid assets like property should rise too. And rising property yields means falling property prices.

What is interesting to us is that this logic has not (yet) applied to residential property. This market has topped out but is less than 1% below its 2022 peak. Which scenario is right? Has commercial property over-reacted? Will residential property follow commercial property down? Our best guess is that the rise in bond yields is over for now which should ease the pressure on both property markets. Still, commercial property looks the better investment to us. If I was buying a residential property today (and I am not I might add!) I would probably wait.

One of these markets is not like the other

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.