For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

In the second half of last year, investors were expecting plenty of bad things for this quarter: a European power crisis, rising unemployment, slowing GDP, risk of recession and a messy China reopening. At the corporate level it wasn’t much better. Corporate profit margins were expected to decline and credit defaults and bankruptcies to rise. Well, so far, it hasn’t been that bad. Equities have recovered some of last year’s losses and we have managed to go through a few months of relative stability. Less news has been good news. That said, I would say the mood has darkened again among investors in the last few weeks. In that spirit, this week I thought I would list three things that are giving me concern today.

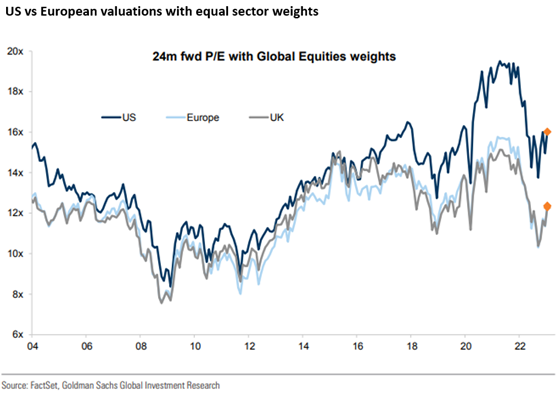

The first is US equity valuations. It has been common to complain over the last few years that US equities are expensive. This has, however, generally been a mistake. US equities were considered expensive 10 years ago for example and have delivered a 225% cumulative total return since then, compared to 87% for Eurozone equities and just 47% for the UK (all measured in US dollars). US equities were, if anything, cheap 10 years ago: a 12.6% annualised return from 2013 is very good historically. The US was simply able to deliver better earnings growth than the rest of the world. This saw the market re-rate higher, adding to US out-performance. But today? You can see below, sector adjusted valuations for the US compared to Europe.

The US valuation premium remains high but I have two problems with it. The first is it was common to say that although US equities looked expensive they were in fact cheap relative to bonds (which have yielded you close to zero for much of the last 10 years). This just isn’t true today. The earnings yield on US equities (so the profits you receive as an investor as a percentage of the price you pay) is 5.5%. US interest rates are 4.75% today and are expected to be close to 5.5% by the middle of the year. That is a whole lot of risk for a cash-like yield! Secondly, much of US success has been down to its concentration in technology driven growth names. The last 18 months has, however, seen the old world recover. Oil and gas and natural resources have been stand out performers. As negative interest rates have disappeared in Europe so banks have started to recover. China re-opening is good news for luxury goods. All this favours Europe and the UK once again. The cheaper and better prices you can find here just makes that opportunity more compelling.

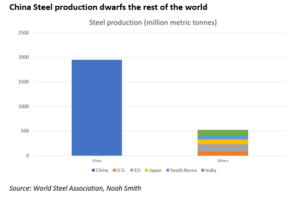

My second area for concern is geopolitical. It looks increasingly likely that China will start to meaningfully help Russia in its war efforts in Ukraine. So far I have been reluctant to describe Russia/Ukraine as a proxy war. Russia invaded Ukraine all by itself. But for the Russia war machine to continue it will need plenty of help from China. It looks like this help might be on its way and it is worth noting that in manufacturing terms, China is a very strong ally. As an example, here is steel production (vital in a war effort) for China vs the rest of the world.

The human cost of a genuine proxy war between China and the West fought in Ukraine would (continue) to be terrible. The financial cost in terms of increased sanctions and deglobalisation would be negative for markets too.

My final concern is that slowly, inexorably, artificial intelligence (AI) is going to change the way many businesses are run today. I am actually generally an optimist on the impact of AI. I think humans working alongside AI are going to revolutionise and improve many service based companies. The problem is there will, however, be plenty of bumps along the way.

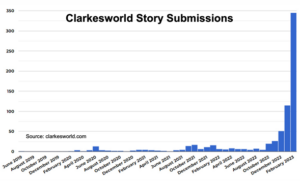

Clarkesworld is a successful science fiction and fantasy magazine. It will pay you 12 cents per word for a story it publishes so that’s $1,200 for a 10,000 word story. It has a reputation for being prompt to review its submissions and to pay you if it publishes them. Here is a chart of the monthly story submissions it receives:

I think its fair to guess that 95% plus of the stories it has received so far this month are generated by AI driven language models (ChatGPT is the most famous example). The magazine has no way to detect computer driven stories so how it filters the fake from the real looks like a real problem to me. The submit, review and pay model has been broken. AI is a brand new technology and it is not obvious today whether (or even how) we should limit or control its growth. I think, though, there will be plenty more Clarkesworld type stories in the months and years to come.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.