For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

The theme of this week is the gap between everyone’s mood (very negative) and the markets (going up). President Truman once famously said that he wanted an economic adviser who was one handed. The reason he gave was that the economic advice he received was always couched with “On the one hand… but on the other…” Sometimes, however, the picture really isn’t clear and you need two hands to manage a portfolio. The start of the year has felt very much like that.

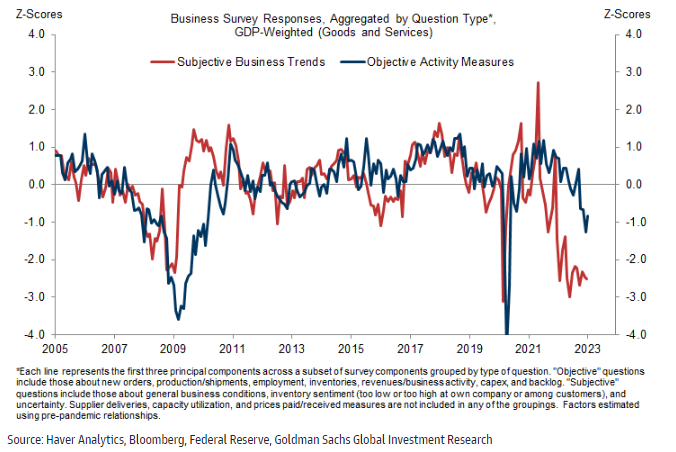

Survey data (where you essentially ask people if things are getting better or worse) looks bad. If all you did was take today’s readings and compare them to periods in the past then we should already be in a recession. However, hard data (actual GDP growth, unemployment, spending etc) still looks decent, especially in the US and Eurozone. Bears will point out that survey data typically leads the hard data. However survey data is not a perfect guide to the future. First, it picks up on more general pessimism (or optimism) about the economy. There has been a lot of recession talk about for the last few months and this inevitably shows up in survey data. Surveys were also similarly pessimistic (and proved to be wrong) when war broke out in the Ukraine for example.

Secondly, inflation has an impact. When inflation is running at 10% your sales are probably going up and you feel good about your business even if most of your sales’ increases are just keeping up with inflation. Similarly, as inflation falls your sales will also look like they are falling even if, inflation adjusted, the picture is much better. One way to try and unpack all this is to separate out business survey questions between subjective “general business condition” style questions and more objective questions about business fundamentals. As you can see in the chart below (via Goldman Sachs), things are slowing down but people look to be much more pessimistic than the hard data might warrant.

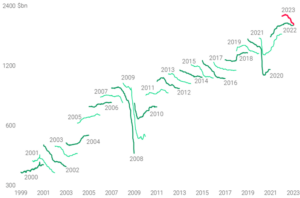

You can also see this story in equity markets. Earnings estimates are being revised sharply down right now (as many predicted at the end of last year). Yet equity markets remain strong. Why? First, equity estimates are always revised down as you can see in the chart below (via Lombard research). Secondly, even after the revisions down, profits, on average, still go up. This is, ultimately how and why you make money investing in equities. This trend still looks intact to us. Finally, remember US equities fell 20% last year partly because investors feared these earnings falls would definitely come. Sometimes, if the bad thing is not as bad as people fear, you will see a relief rally. Whatever the survey data is saying, this year feels very much like that so far.

Consensus net income estimates for the S&P 500

Source: Lombard Research

Finally, for an example of hard data surprising to the upside, data for UK residential property transactions came out this week. December’s transactions remained 3% higher than the pre-pandemic average. If there was one place we expect to see the impact of higher interest rates bite it is in residential property. And yet this looks to me to be remarkably strong. A slowdown is surely coming, but it is not here yet.

Source: Builtplace, HMRC

I spoke at a client event this week and ended up summarising our positioning pretty simply. We are overweight bonds as we think a slowdown is underway and locking in today’s fixed income yields feels like a good opportunity. We have, however, kept a good part of our overall risk on. If the bad thing does not happen there is plenty of upside and we need to make sure we capture that in our portfolios. Nothing I saw in markets or data this week has shaken my view that this is the right place to be today.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.