For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Bond markets can sometimes be confusing. Interest rates rose by 0.5% yesterday in the UK but longer term interest rates also fell sharply. For those with shorter attention spans, I can tell you this was generally good news for your investment portfolios. For those tempted to read on, this week’s note does its best to explain what is going on in UK bond markets. As ever, if you want more colour please feel free to get in touch.

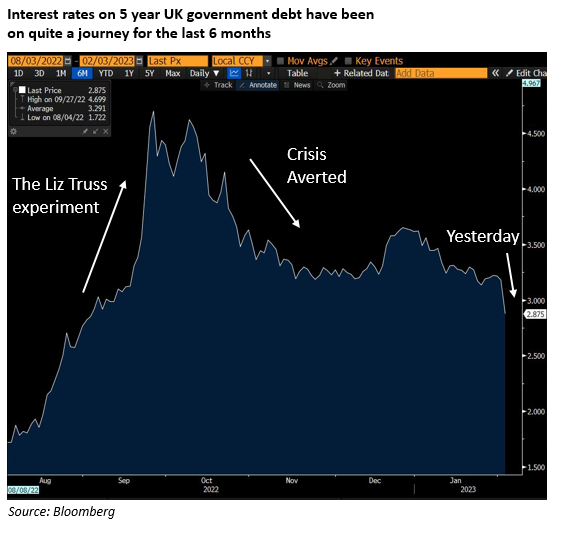

Base interest rates went up by 0.5% to 4% in the UK yesterday. At the same time, interest rates that are used in calculating borrowing rates for cars and houses actually fell pretty sharply. The interest rate on the 5 year gilt, for example, has fallen from 3.25% at the start of February to below 2.90% as I write (see the chart below). This interest rate was over 4.5% during the peak of the Liz Truss crisis and is the basis for calculating a 5 year fixed rate mortgage for example. Savers are making more on their deposits and borrowers are paying less on their loans. No wonder equities are going up!

What is going on here? One key thing to understand is that the 5 year interest rate is, more or less, the average expected bank base rate over the next 5 years. So the market is telling you that bank base rates will probably (after one more rise this year) start to fall again back below 3%. One reason for this optimism is that markets are becoming increasingly convinced the battle against inflation is over. When there is enough data available for central banks to come to the same conclusion (and we are not there yet) then they will be more likely to cut interest rates again. The market now thinks that cut is coming in December, by the way, just in time for Christmas. The interest rate used to calculate the loans for cars and houses effectively already has these cuts already priced into them. If this trend holds, it wouldn’t surprise me to see some 5 year fixed rate mortgage deals below the Bank of England’s 4% base rate today.

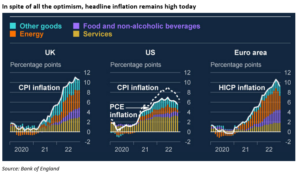

One reason for the optimism on inflation is that the energy price shock has not been as bad as the market feared going into the year. To illustrate this, the Bank of England produced a chart yesterday showing the drop in expected longer term energy prices since its last quarterly outlook in November. Another piece of good news for UK inflation is that Sterling has recovered (against the US dollar at least) helping the price of imported goods and especially oil.

All markets look forward, and they look further forward than central bankers are, in reality, allowed to. To illustrate this, it is worth remembering that UK inflation rates are still above 10%. UK wage increases are running at over 6% (and are higher than the US and Europe). Still equities are rising not falling. The bullish explanation is that if the peak really is in for inflation, interest rates paid by borrowers can fall again breathing some life back into the economy. This has been the story of the year so far.

A more bearish explanation is that the Bank of England has already raised interest rates too much. A recession is on its way and the market is already pricing in the interest rate cuts needed to fight that recession. For those who are more visual learners, we finish with an illustration of this scenario done by one of our research providers (Dario Perkins of Lombard Research). This still feels like the most likely outcome to us. We added to our bond exposures in the second half last year for precisely this reason. Yesterday was another good day for those investments.

If you are wondering why we are not more bearishly positioned over all, it is worth remembering that the US, China and even Europe look to be much better placed to avoid a downturn than the UK. The majority of your equity investments remain overseas and many UK companies are exporters. Sometimes, the bad thing not happening is enough to see markets recover. There remains a decent chance these economies avoid a sharp slowdown and we want to make sure we are there to profit if they do.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.