For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

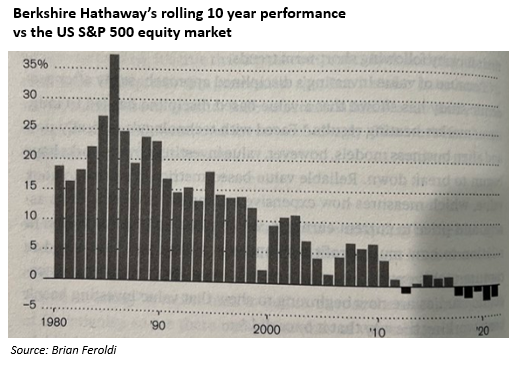

Warren Buffett’s 2023 letter to his shareholders came out last week. Having beaten the US market by over 20% in 2022 he took (another) deserved lap of honour and, as always, the letter offers simple and timeless advice on how to invest. His company, Berkshire Hathaway, does have one challenge though. At today’s $675bn market capitalisation it is hard to find the growth that really makes a difference. You can see this in the chart below of Berkshire’s 10 year share price performance compared to the US S&P 500 equity market. When Berkshire was relatively small in the 1970s and 1980s it handily beat the market over each rolling 10 year period. However, more recently you can see the impact of Berkshire’s size. For the last 5 rolling 10 year periods it has started to underperform and even after last year’s bumper return it is still (a little) behind as I write.

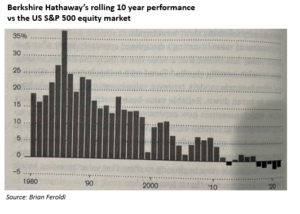

I mention this not to try and get a one up on the world’s greatest investor, but more to flag the fact that once companies reach a certain (very large) size they (naturally and understandably) find it harder to grow. And even Warren Buffet hasn’t been able to overcome these limits. All this is relevant because the last 15 years have been dominated by the rise of the US technology giants, and in particular Facebook, Apple, Amazon, Microsoft and Google. It is looking to us that, finally, these companies might also be reaching their growth limits. The chart below, from Goldman Sachs, shows the profits of these companies relative to the profits of the rest of the US market. You can see the extraordinary growth of the last 15 years but you can also see the sharp recent relative fall.

All this encourages us to look hard elsewhere for the next decade’s winners. We have kept an allocation to small and mid-size equities in the US and Europe in part because the next generation’s winners often start small. We have also written here recently about Europe and Emerging Markets looking more attractive than they have done in a while. Betting against the US technology giants was a pretty painful strategy in the 2010s, but it might be the right one for the rest of the 2020s.

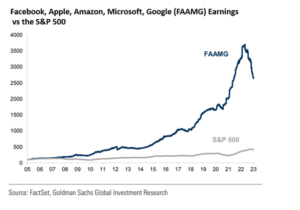

Finally, a word on inflation. In about 4 weeks we have gone from worrying about recession and deflation back to worrying about over-heating. February felt like much of last year for bond markets as yields started to climb higher once again. The chart below shows price increase for selected items since the 2000s. What is clear from this chart is it was services (like healthcare, education and childcare) where we saw the fastest inflation. This was offset by falls in prices for goods (like TVs, computers and toys).

Covid of course turned this upside down. Suddenly goods became scarce as the factories that made them shut down. However, the Covid supply disruptions look to be more or less over and in the last few months the prices of goods have started to fall again. Will this be enough to offset (still strong) service inflation? Or is the era of structural goods deflation finally over? If it is, then we will need service inflation to come down. This, unfortunately, normally only happens with a rise in unemployment and so recession.

A couple of causes for optimism here are commodity prices (falling not rising) and shipping costs which are now back to their pre-covid levels (having risen over 600% in 2020/21!). If we do need a recession to bring down inflation then bond markets will ultimately be the right place to be. However, the battle against inflation is not over and, until it is, bond markets look likely to continue to feel the heat.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.