The person who coined the phrase “Santa rally” was only actually referring to the last 5 trading days of the year. November saw the 7th largest monthly rise for the S&P 500 in history (+8.9% although a weaker dollar means this was only +4.8% in GBP terms). I don’t know what to call this: the fireworks rally (am thinking Guy Fawkes here), the Turkey rally (for Thanksgiving?). Still, the end of the year is often a stronger one for returns and it has so far proved to be the case again this year.

Part of the reason is that falling inflation and interest rates without a recession is generally a pretty good environment for risk assets like equities. The US is now expecting 1% in rate cuts next year vs the 5.25% in rate rises we saw over 2022 and 2023. A slowdown triggered by the delayed impact of these rate rises still feels pretty likely to me but it is always worth asking what could go right from here? And if things do go right, which markets have the most upside? And this got me thinking of Europe.

The charts and analysis below refer to the Eurozone but I think you can make a similar case for the UK with two extra provisos. Firstly, the nature of our mortgage market means we are more sensitive to interest rate rises and secondly, wage inflation is running hotter here than in the rest of the world. This reduces the Bank of England’s ability to cut interest rates at the same time as it increases the pain the economy feels of having them high.

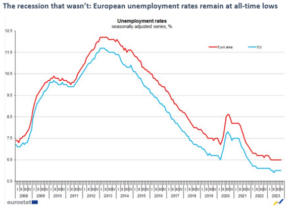

This means for me the Eurozone is probably a more attractive opportunity today. Germany has had to wrestle with being hardest hit by the Russian gas supply shock, as well as one of its largest export markets (China) struggling. What has been remarkable to me is that so far you can’t see the impact of any of this in the unemployment data. The Eurozone has also managed to avoid a recession.

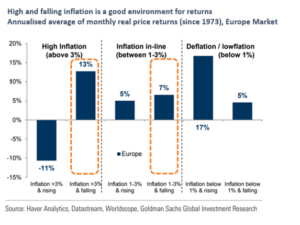

Given the problems Europe has faced, there are good reasons to be more optimistic about the future today than you would have been 12 months ago. Forward looking survey data is bottoming and (just) starting to improve. Inflation is falling. And it is worth noting that high and falling inflation has historically been fertile ground for European equity market returns:

One thing you learn quickly in this job is that valuations don’t really tell you anything about the next 12-month returns. But they do tell you how much upside there is if markets start moving your way, and I think there is plenty of room for upside when you look at European equity valuations. They remain near historic lows whether you look at next year’s forward earnings or 10-year average earnings (the so called Shiller P/E multiple).

I used to work with a wag who said if you want something going cheap, buy a budgie. What he was getting at is that low valuations don’t mean much without some sort of catalyst. One reason European equities are cheap (and you can definitely include the UK here by the way), is that they have not done a good job of growing their earnings. Nearly all the post-2008 growth in profits ended up going to US companies. However, it is worth noting that in 2020 this under-performance stopped and in recent years Europe has actually seen faster earnings’ growth than the US. If Europe can keep this up then surely, surely, there will be some upside for European markets in the next few years.

I have been doing this job long enough to realise that the hit rate of ideas like “now is the time for [insert cheap market here] to out-perform” is not 100%. US exceptionalism has been the story of the last decade and more, and lead they have in technology (especially in AI) is only growing. There have, however, been windows of good performance for the rest of the world over that time period, normally coinciding with stable and improving economic growth. The set up for European equities looks pretty attractive to me here. Europe has suffered from Covid, inflation, an energy price shock and sharply rising interest rates. If the worst of this is over, then it might yet be the right place to be in 2024.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.