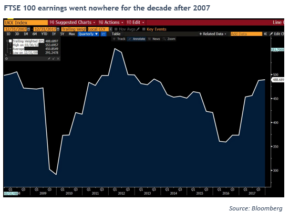

I write a lot here about inflation, interest rates and the economy. But this is (at best) half the story of what really moves markets. The other half is: are the companies we are investing in actually making more money next year than this year? If the answer is no then it really doesn’t matter whether inflation is falling or rising or if the economy is having a decent year. Here are the total earnings (so profits) for the UK FTSE 100 market for the decade from 2007. They fell hard in the 2008 crisis as you would expect, they then recovered but essentially went nowhere for a decade. Unsurprisingly, this was also not a great decade to be an investor in UK plc.

I mention this because it looks like this will be the 14th week in the last 16 that equities have risen. And I don’t think this has that much to do with inflation or the economy (if anything, inflation has been showing signs of life again this year). Instead, bottom up earnings are coming through in the sector (technology) where investors have the most optimism for the future. It turns out that for Artificial Intelligence software to be useful it needs to be trained on huge amounts of data and then be fast to deliver results. This puts pressure on the servers it uses to run its computations, therefore they need the very best hardware and software. And the very best hardware and software is made by Nvidia.

Nvidia made $6bn in profit in the 2023 financial year. It is on course to make $30bn this year and is expected to make almost $60bn in 2025 (with revenue rising by 4 times in that period). And Nvidia is not a small company. It was worth $360bn at the end of 2022. Today it is worth more than all the companies listed on the German Dax index put together. This means it is large enough to drive markets higher pretty much all by itself.

The spike you see at the end of the chart is from this week’s earnings results which (needless to say) continued to deliver incredible growth. Of course, if you don’t own Nvidia (or the other US tech giants) it is tempting to dismiss this as a fad or mania. Maybe, (unlike the 2000 dotcom mania) but the profits and revenues Nvidia (and others) are making are real and large. I also feel we own our fair share of Nvidia and US technology through our global passive holdings so I don’t have to be too defensive about all of this.

But before I get too carried away with all things in the future, we balance our US exposure with some (much cheaper) European investments. The comfort I take with these is that European earnings have also been growing recently. In the last chart you can see that the under-performance of European markets in the 2010s was driven by the fact that European earnings significantly under-performed the US. This underperformance reversed in 2020. And of course, the advantage Europe holds over the US is that expectations are much lower today. Sometimes, (as was the case in 2023) all you need is for the bad thing not to happen for Europe to have a good year.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.