One of the things I was taught as a child was that you should not discuss religion, politics, sex or money in polite society. Given I regularly write about two of these (money and politics) I thought it would be safe this week to add a third (you’ll have to read to the end though to find out which). The reason I am broadening out a bit this week is that today is the last day of the financial quarter. I am therefore also writing a longer summary of what happened in Q1, our current positioning and our outlook for the rest of the year. It will be ready early next week and will go out as usual with the quarterly valuations. But if you would like an advance copy (or are not yet an IPS client) then please do get in touch.

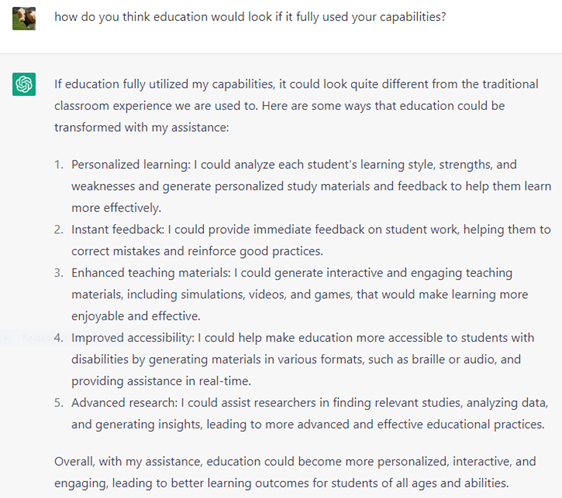

I thought this week I’d therefore cover three topics that are less newsy but much more likely to be viewed as important by future historians when they look back on this era. The first has to be the growth of language learning models (LLMs) like ChatGPT. These look today to be big upgrades on traditional search engines and Wikipedia. You can ask them pretty much anything and they will (usually) give a sensible, well-reasoned answer. For instance, I asked ChatGPT how LLMs might help with education:

We are developing teachers that know more than any of us, are always available and can give instant feedback and personalised study plans. This feels like a huge positive development for society and it is happening right now. There are also, of course, some very obvious concerns with the onward march of technology. First, this is an (early) step on the road to full artificial intelligence (AI). You don’t have to have watched The Matrix or the Terminator to understand the risks here. All I will say is whatever your concerns are AI is coming. The more we can do as a society to understand its implications and prepare for it now the better.

The second worry is that ChatGPT will – as technological advances have done throughout the years – replace existing workers and drive unemployment up. Legal assistants and call centre help-desks look to be pretty vulnerable to me right now for example. But it is also worth thinking about a country like India. The growth of India (and China) has been one of the great under-appreciated stories of human progress in the last few decades. Hundreds of millions of people have been lifted from extreme poverty and this progress is continuing today. Here are 2022 GDP growth numbers for example. India is top. 8.2% growth for a country with 1.4bn people is a big deal.

But it is worth noting that part of India’s growth has come from outsourcing, and especially from outsourcing in technology, software and finance. Indeed, by one measure its software services exports were larger than Saudi Arabia’s oil exports in 2022.

But how many of those software outsourcing jobs will be able to be done more quickly and easily by AI and LLMs like Chat-GPT? My guess is a lot. But, equally, it is hard to think of a country that might benefit more from making education cheaper, better and more widely available. If there is one country that encapsulates the opportunities and threats that LLMs and AI might bring it is India.

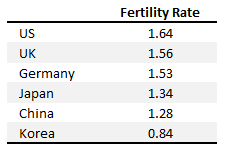

Which brings me to sex. Another advantage India has is that its birth rate is high enough to keep its population growing. This is just not the case any more in most developed countries. Each female needs to have 2.1 children on average to keep population numbers stable. Here are fertility rates for a few selected richer countries:

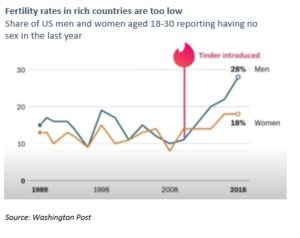

It looks likely (see the last chart) that technology and the retreat into the world of our phones is playing a role here. There are, of course, plenty of financial and market implications to be derived from this but, this is a short note and less market focussed this week. All I would say – and I speak as a qualified actuary here – we need to be having more sex.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.