My parents want to sell their house. They live in the country and, as they get older, want something that is more walkable to the shops and less maintenance. They have in mind the price they want but they aren’t in a hurry to sell and don’t have a mortgage or need one for the new place. Unsurprisingly, the house has been sitting (quietly, unofficially) on the market for 6 months now. I think there are plenty of phantom sellers like this. Outside of death and divorce the other major trigger to force you to sell a property is losing your job. But (thankfully) the economy remains strong and unemployment is low. There aren’t many people forced to sell for economic reasons either.

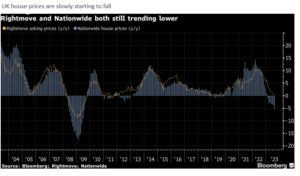

Meanwhile, interest rates have risen from basically 0% to 5.25% today. If you assume mortgage rates for a typical borrower have risen from 1.5% to 5% then – keeping the monthly repayment constant – this implies the house price a mortgaged buyer could afford has fallen by around 30% from its 2021 levels. It looks to us like UK commercial property has already made much of this adjustment (prices in many markets fell around 20% in the second half of 2022 for example). This has not, however, been the case for residential property. Given the lack of sellers who are forced to accept the new reality it is not surprising that transaction volumes are falling and house prices are only just starting to adjust. Unsurprisingly, if the Rightmove asking price index is a guide, there look to be more falls in the pipeline:

What happens from here? At the start of the year, many people expected the shock of higher rates to push to the economy into a slowdown and recession. Rising unemployment would force steeper falls in residential property as rising unemployment would force more properties onto the market. Happily, and surprisingly to many, this has not yet been the case. A UK recession continually feels just around the corner but never seems to arrive. One reason is that plenty of property owners (like my parents) don’t have a mortgage but are instead savers who benefit from higher rates. Even for those that do have a mortgage, the impact of rising rates is slow as people gradually roll off their old fixed rate deals. The weighted average mortgage rate is still 3% for outstanding mortgages, compared to 4.7% for new ones:

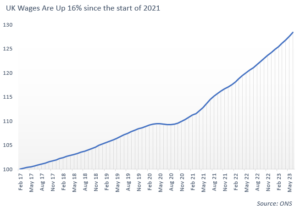

Instead of a sharp sudden shock, the alternative is that the market grinds sideways while wages slowly rise and allow incomes to grow into the new, higher mortgage rates. This looks to be the story so far. Wage growth remains strong (over 8% year on year through to June) and wages are up 16% since the start of 2021. There is plenty of negative commentary written these days about the UK economy but I can remember far worse economic environments than today’s low unemployment and rising wages. If house prices need to fall by 30% to keep affordability constant, maybe half that fall has already been offset by rising incomes.

So, a sideways market looks to be best residential property investors can hope for. It would also be consistent with the UK economy continuing to avoid a nasty recession. That said, other investment markets (most notably equities and bonds) fell sharply when interest rates rose in 2022. Residential property just hasn’t yet made that adjustment. This means it does not look like a very interesting investment opportunity to us today. If my parents do get an offer near what they are looking for, I’ll be advising them to take it.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.