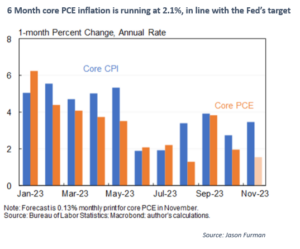

It’s been a big couple of weeks for inflation related data and I am pleased to be able to tell you that the numbers have (mostly) been pretty positive. UK wage inflation (which has been running hot) came in below expectations. The US saw CPI data come in in line but, at the risk of losing half of my audience here, the Fed’s preferred measure of inflation is Core PCE. Core here means it excludes volatile elements like energy (which has also been falling by the way) and PCE is generally considered to include a broader range of goods and so be more accurate and stable than CPI. Anyway, this measure is now at 2.1% annualised over the last 6 months, in line with the Fed’s 2% target.

This means the Fed’s work looks to be done (for now) and they admitted as much at this week’s press conference. The US is now pricing in 6 rate cuts for 2024, taking the upper end of the Fed’s base rate from 5.5% today to 4.0% by December 2024. This is important as (i) the US is the world’s largest economy and (ii) its inflation cycle has generally been ahead of the UK and Europe (Putin’s invasion of Ukraine caused an extra inflationary bump for us in 2022 which the US did not really experience). The hope (and market expectation) is that the UK and Europe will also get on target sometime next year.

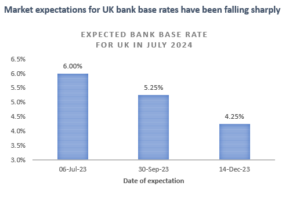

And this means I have some good news for UK mortgage borrowers. In July this year the market thought that the UK bank base rate would be at 6% in 12 months’ time (so in July 2024). Today that expected rate is 4.25%. The 5-year government bond yield (relevant for 5-year fixed mortgages) has fallen by over 1% in the last few months. I hope this means those of you who have to refinance their mortgage next year have a slightly less painful experience.

There has been a similar sense of relief for those sectors hardest hit by rising interest rates. Small and medium capitalisation equities bounced in November and then bounced again this week. Real estate (and the broader investment trust market) is also seeing a relief rally. Part of the worry in the middle of the year was that large deficit spending and borrowing by governments would keep pushing interest rates higher. That argument looks less convincing today: interest rates are falling even as government spending remains high. Central banks look to be back in control.

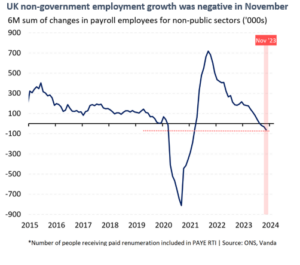

If that is the good news, what is there to keep the Christmas Grinch happy? I think there are a couple of things to worry about even as markets rally. The first is that along with the good news on UK wages and inflation came bad news on employment. Private employment growth in November was negative for the first time since Covid hit in 2020. If this had happened in the US then I have a hard time imagining markets would be rallying. For once I am glad that the UK is only 3% of global GDP. The UK economy is most vulnerable to the impact of higher rates because of its large, shorter dated mortgage market. It’s possible that rising interest rates take longer to have an impact than people think today. If that is the case then the UK may not yet escape recession.

Finally, the one thing that kept me optimistic at the end of last year was just how gloomy everyone else was. There is an old market adage that when all the experts and forecasts agree, something else is going to happen. Everyone in 2022 thought a recession was inevitable in 2023. Lo and behold, 2023 has turned out to be a pretty decent year with unemployment staying near all-time lows. Now people are much more optimistic. The soft landing from the economy from higher interest rates is here. I just hope the consensus is right this time.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.