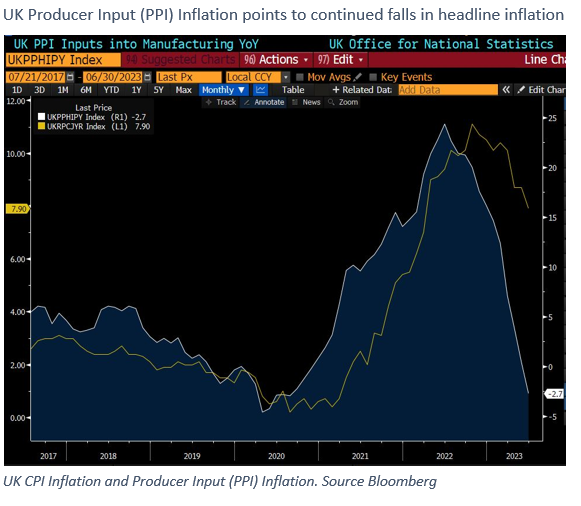

Finally, some good inflation news out of the UK this week. We saw a relief rally in UK government bonds (up 1.6% so far this week) and UK mid-cap equities (the FTSE 250 Index is +3.8%). Frankly, we were expecting this to happen earlier in the year, but it was good to finally see some evidence that the worst for the UK is behind us. Inflation for the inputs producers use to make things (PPI in the jargon) is now negative -2.7% year on year. As you can see below, PPI inflation led headline inflation on the way up. It is now pointing to further good news on UK inflation in the next few months. This week’s numbers should be the start of a trend down rather than a one-month blip.

PPI-inflation

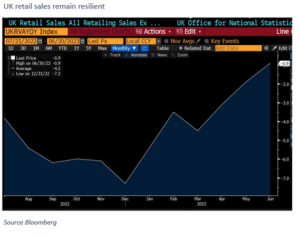

This should also mean markets will continue to pivot to worry more about growth weakening than inflation rising. On Friday, UK retail sales data came out for June and it looked remarkably strong. The US has (so far) been able to see inflation fall significantly without rises in unemployment. It will be harder for the UK to pull off this trick. Mortgage payments here are more sensitive to rising interest rates and the energy shock has been larger. But in spite of all this we haven’t seen much weakening in UK consumer demand yet. And as inflation falls, real wages (i.e. what you earn after inflation) rise. Some of last year’s headwinds will slowly start turning into tailwinds.

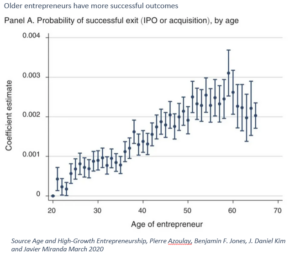

So, maybe I should start taking it all a bit easier. Unfortunately, I saw some data this week that says now is the time to really put the effort in. Mark Zuckerberg is the role model for the young entrepreneur. He started Facebook while at university and is now one of the richest people on the planet. It is tempting to think that if you haven’t made it by 40, you are never going to make it. In fact, this cult of youth is misleading. Researchers at MIT have shown that the older you are as an entrepreneur, the more likely you are to have a successful sale of your business. Morris Chang started Taiwan Semiconductor (TSMC) at age 56. It is now the most advanced computer chip manufacturer in the world and worth over half a trillion dollars. That is 4 years older than I am today. At least I have a few years to come up with something.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.