A commentary from Anne McClean, Head of Wealth at IPS Capital:

Jeremy Hunt made two big announcements regarding pensions in yesterday’s budget.

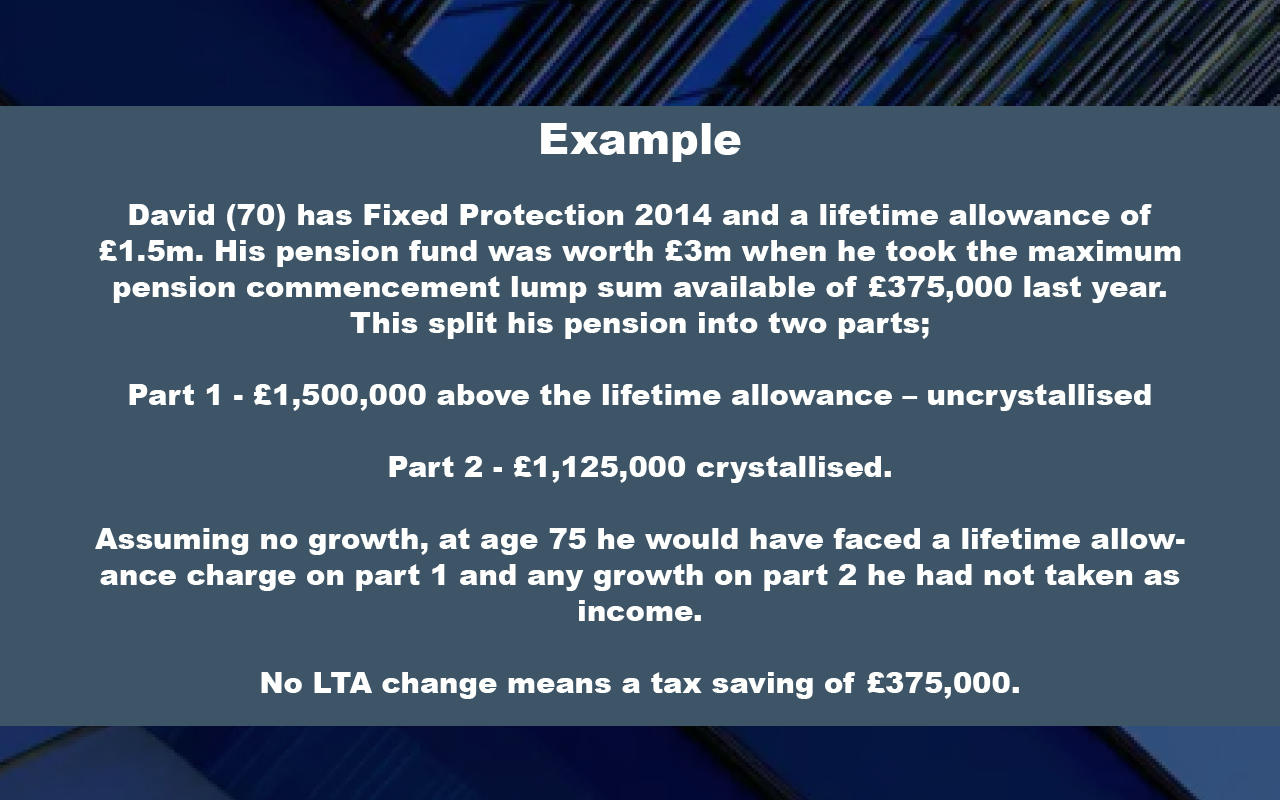

The Lifetime Allowance charge will be removed from 6th April 2023 and fully abolished in April 2024. Talk over the last few days had been around an increase to £1.8m but Mr Hunt has gone much further. One large caveat is the maximum Pension Commencement Lump Sum will be retained at the current level of £268,275.

This is great news for anyone who has already breached their lifetime allowance as this will remove the charge and increase the value of their pension, potentially allowing them to draw more income. Clients in drawdown should review their position.

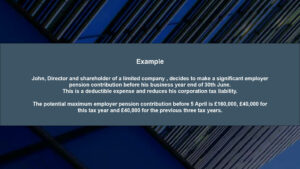

It is also good news for anyone with pension funds hovering around £1,073,000 and, in a position, to make further contributions to pensions. Those who have opted out of employers schemes and those who are earning between £100,000 and £125,000 should be reviewing their position in light of the ability to make future contributions.

That said, Labour have come out this morning and vowed to reverse the decision. For those already above the lifetime allowance, this means making some important decisions in 2023/2024 tax year.

Annual allowance and Tapered Annual Allowance

Individuals will be able to increase contributions from £40,000 to £60,000. The detail around carry forward is yet to be announced at the time of writing but the principle remains in place.

From 6 April 2023, those earning in excess of £260,000, have their annual allowance tapered away. The maximum reduction is now £30,000, meaning those earning in excess of £360,000 can pay a maximum pension contribution of £10,000 per year.

Who is impacted by the change

- Those who have only taken their pension commencement lump sum and left funds above their lifetime allowance uncrystallised

- Those with pension funds above £1m

- High earners who have opted out of their employer schemes

- Those earning in excess of £360,000

For more information, please get in touch with Anne: amcclean@ips.meandhimdesign.co.uk