This week: how active should you be as an investor? I think there are broadly two sorts of activity. One is jumping in and out of markets from cash to being invested and back again depending on how bullish you feel. The other is staying invested but always looking out for the best opportunities you see along the way.

I generally prefer the second approach. I was reminded of why by a piece of personal finance research I saw this week put out by Charles Schwab. The 20-year period they used for their numbers is a bit suspect because it starts at the end of 2002 (near the market lows after the dot-com crash), but the point it makes is I think generally correct: for longer term investors (and here I mean 10 plus years) it does not matter that much whether you time the lows perfectly or get unlucky and invest right at the top. The most important decision is to invest and stay invested.

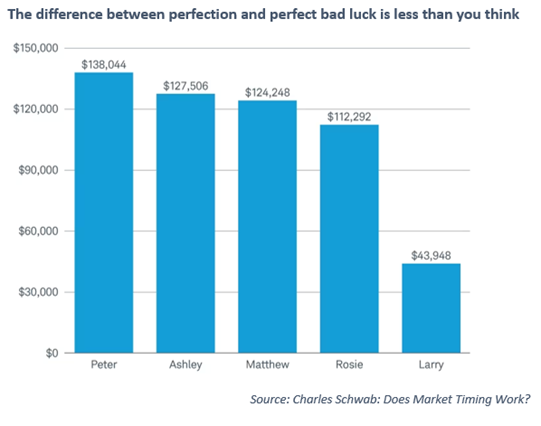

To illustrate this, they assumed you had $2000 to invest each year for 20 years. They then assumed five strategies (and I will follow the Charles Schwab naming convention here – apologies in advance):

- Peter Perfect: invests perfectly at the lows of the year, every year. The dream of the active manager.

- Ashley Action: invests on the first trading day of the year.

- Matthew Monthly: divides his $2,000 in 12 equal portions and invests this at the start of every month.

- Rosie Rotten: the opposite of Peter, invests it all at the highs for the year each and every year. This would have me waking up in cold sweats every night if I managed to do it in practice.

- Larry Linger: stayed in cash waiting for the crash/markets to fall. To be fair, this did happen in 2008, but if you were already nervous, this event would probably be enough to keep Larry in cash permanently.

The results of these five strategies are here:

You can see that the difference between the best and worst you can do (Peter and Rosie) is less than you think. Larry shows that staying in cash can have little cost in the short run, but large costs in the long run. In practice, at IPS we tend to use a blend of Ashley (invest up front) and Matthew (drip in over time) for new clients. If nothing else, averaging out the investment decision a little reduces the potential emotional toll, if you do happen to be unlucky that year.

This also looks to be an argument against overly active management. Here I would point out that the study above assumes you put it all into the US S&P 500 market which just happens to have been the best performing market of the last 20 years. And here my advice to clients would be: if you do happen to know what the best performing market will be over the next 20 years, simply invest regularly in that and stick with the ups and downs.

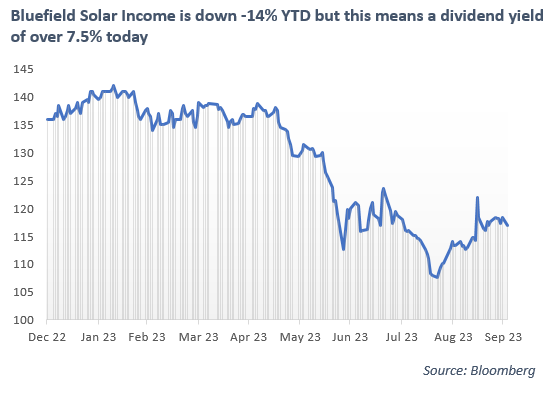

Given today’s high starting valuations it is not obvious to me that this will continue to be the US. I wrote our quarterly review last week. One point I made is that rising interest rates had created plenty of new interesting opportunities today. Over the 20 years of the Charles Schwab study UK equities annualised at 7.7% per annum. US equities (the best performing major market) beat this at 9.8% per annum. These are both in line with the 7%-9% range I would assume for long term equity returns. Interestingly, many investment trusts – which have fallen hard this year – now look to be priced to generate these sorts of returns. I would also argue the return journey should be smoother and you have some inflation protection as well.

One example here is Bluefield – an investment trust that owns a number of UK solar farms. This will pay you a (growing) dividend of 7.6% today which is 1.7x covered by earnings. The most important decision is to stay invested. The good news today is there are many more attractive options as to where to place that investment.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown

CIO

IPS Capital

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.