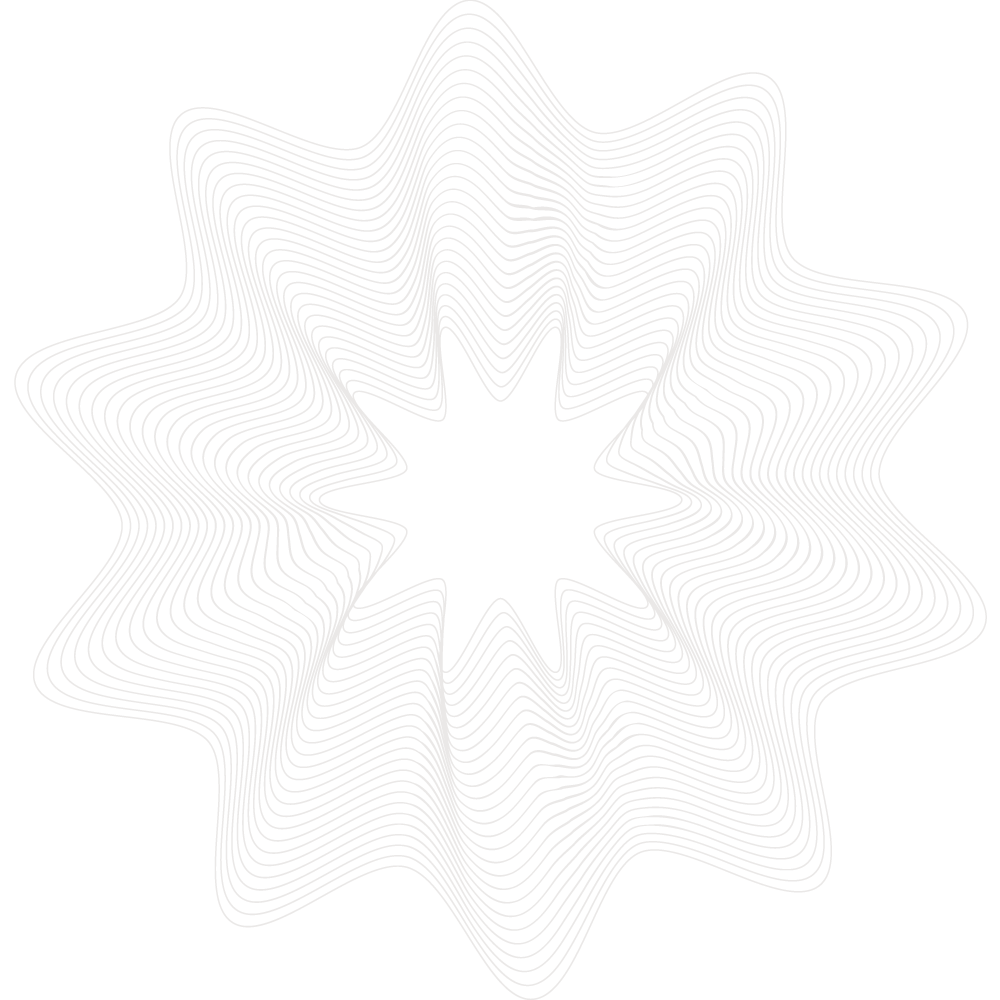

Jeremy Hunt, the UK Chancellor, hinted this week that he might introduce a “British ISA” in this week’s budget. The aim would be to encourage (tax-free) investment into UK companies. Of course, part of the reason here is that he has a large UK company (Natwest) that he wants to sell us. However, probably a more fundamental reason is that UK equity valuations are among the cheapest in the world. The UK just does not have many large companies that are attractive to global investors. This creates a bit of doom loop: the less attractive the UK is, the harder it is to generate investment in UK companies. And the less investment we have in UK companies, the less likely we are to generate future winners that will in turn attract global investors.

So, I understand why the government is thinking of this and the moribund UK market could certainly do with a shot in the arm. However, I am sceptical it will be much of a game changer for a couple of reasons. First, the chart above is looking at the price you pay for global companies. But what ultimately matters is how they actually perform. In the short run flows can move prices higher but in the long run it is the ability of the company to generate profits that really generates returns. And here the UK has just not done a great job compared to the rest of the world. As an example, Natwest has generated precisely zero profits over the last 11 years combined. If it matches that performance over the next 11 years it will be a terrible investment, whatever the initial hype and flows on a government sale are like.

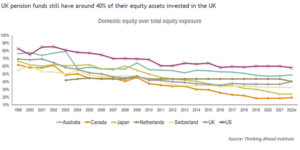

Secondly, it is not obvious to me that UK investors are under-invested overall in UK assets compared to their international peers. The chart below shows data put together by the Thinking Ahead Institute showing equity allocations for global pension funds. The UK still has, on average, over 40% invested in UK equity assets. This is above, for example, Switzerland, Japan or Canada (and well above the 4% weight the UK has on global equity indices). The money that has been flowing out of UK equities is probably more a result of pension fund de-risking (so investing more in bonds and less in equities). It is not obvious to me what the government can do to halt that trend, especially with the higher interest rates on offer to pension funds today.

That said, I don’t want to be too gloomy. I am looking forward to this week’s budget and am optimistic UK investors may get a bit of a reprieve after a tough start for the year. But once the initial shot in the arm has been applied, UK companies need to take this opportunity to start delivering better results for investors over the next 10 years than they have over the last 10. Only in this way can true salvation be delivered.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.